Sextant PME N

FR0013306370

Sextant PME N/ FR0013306370 /

| NAV2024-04-25 |

Chg.-2.3000 |

Type of yield |

Investment Focus |

Investment company |

| 282.5100EUR |

-0.81% |

reinvestment |

Equity

Europe

|

Amiral Gestion ▶ |

Investment strategy

SEXTANT PME is a dynamic fund aiming to optimise performance through a selection of international equities and more specifically European Union and European Economic Area equities, without reference to an index.

The strategy to achieve the investment objective of the SEXTANT PME Fund is based on a highly disciplined stock picking approach, after a fundamental multiple-criterion analysis specific to the investment management firm.In accordance with the eligibility criteria for the "PEA-PME" personal equity savings plan, the Fund is at least 75% invested in European Union and European Economic Area equities and has at least 60% exposure to equities irrespective of market capitalisation or sector.The Fund reserves the right to invest up to at most 25% in debt securities, money market instruments and all fixed-income securities irrespective of currency and creditworthiness, and in non-EU equities (including emerging equities). Investments in speculative "high-yield" bonds and securities with a Standard & Poor’s rating of less than BBB- will remain accessory, i.e. will not exceed 25% of assets.The Fund may invest up to 10% of its assets in securities of other French and/or European coordinated UCITS, in particular to invest cash holdings.Futures and securities that include derivatives may be used to expose the fund to a favourable movement - or for partial coverage against an unfavourable trend - in equities, interest rates, indices or forex. There will be no excessive exposure of the portfolio to equity or cred

Investment goal

SEXTANT PME is a dynamic fund aiming to optimise performance through a selection of international equities and more specifically European Union and European Economic Area equities, without reference to an index.

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Equity |

| Region: |

Europe |

| Branch: |

Mixed Sectors |

| Benchmark: |

- |

| Business year start: |

01-01 |

| Last Distribution: |

- |

| Depository bank: |

CACEIS Bank |

| Fund domicile: |

France |

| Distribution permission: |

Switzerland |

| Fund manager: |

Raphaël Moreau |

| Fund volume: |

- |

| Launch date: |

2017-12-29 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

5.00% |

| Max. Administration Fee: |

1.30% |

| Minimum investment: |

0.00 EUR |

| Deposit fees: |

- |

| Redemption charge: |

1.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Amiral Gestion |

| Address: |

103 rue de Grenelle, 75007, Paris |

| Country: |

France |

| Internet: |

www.amiralgestion.com

|

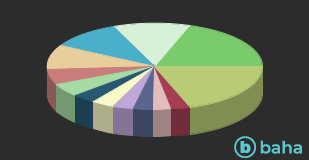

Countries

| France |

|

44.10% |

| Sweden |

|

19.10% |

| Germany |

|

14.00% |

| Italy |

|

6.90% |

| Austria |

|

4.20% |

| Belgium |

|

3.90% |

| Norway |

|

2.90% |

| Others |

|

4.90% |

Branches

| Industry |

|

19.80% |

| IT/Telecommunication |

|

11.50% |

| Construction |

|

10.70% |

| Finance |

|

9.10% |

| various sectors |

|

5.80% |

| Grocery Producers |

|

5.00% |

| Commodities |

|

3.50% |

| Media |

|

3.30% |

| Consumer goods |

|

3.10% |

| other assets |

|

3.00% |

| Retail |

|

2.80% |

| automotive |

|

2.80% |

| Others |

|

19.60% |