PrivilEdge Fidelity T.(USD)PA USD

LU1390458310

PrivilEdge Fidelity T.(USD)PA USD/ LU1390458310 /

| NAV5/16/2024 |

Chg.+0.4201 |

Type of yield |

Investment Focus |

Investment company |

| 92.0679USD |

+0.46% |

reinvestment |

Equity

Worldwide

|

Lombard Odier F.(EU) ▶ |

Investment strategy

The Sub-Fund is actively managed in reference to a benchmark. The MSCI AC Information Technology USD (the "Benchmark") is used for performance comparison and for internal risk monitoring purposes only, without implying any particular constraints to the Sub-Fund's investments.

The Sub-Fund"s securities will generally be similar to those of the Benchmark but the security weightings are expected to differ materially. The Investment Manager may also select securities not included in the Benchmark in order to take advantage of investment opportunities. The Sub-Fund aims to generate capital growth over the long term with a level of income expected to be low. It mainly invests in shares issued by companies worldwide that will provide or benefit from technological advances and improvements in relation to products, processes or services. Even if a large part of the underlying shares will be incorparated in North America or Europe, the Investment Manager keep his freedom to invest outside these countries, like in Asia and in other Emerging Markets.

Investment goal

The Sub-Fund is actively managed in reference to a benchmark. The MSCI AC Information Technology USD (the "Benchmark") is used for performance comparison and for internal risk monitoring purposes only, without implying any particular constraints to the Sub-Fund's investments.

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Equity |

| Region: |

Worldwide |

| Branch: |

Sector Technology |

| Benchmark: |

MSCI AC Information Technology USD |

| Business year start: |

10/1 |

| Last Distribution: |

- |

| Depository bank: |

CACEIS Bank, Luxembourg Branch |

| Fund domicile: |

Luxembourg |

| Distribution permission: |

Austria, Germany, Switzerland, Luxembourg |

| Fund manager: |

Fidelity International Limited |

| Fund volume: |

696.96 mill.

USD

|

| Launch date: |

6/30/2016 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

5.00% |

| Max. Administration Fee: |

0.80% |

| Minimum investment: |

3,000.00 USD |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Lombard Odier F.(EU) |

| Address: |

291, route d'Arlon, L-1150, Luxembourg |

| Country: |

Luxembourg |

| Internet: |

www.lombardodier.com

|

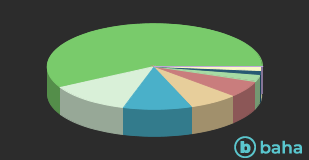

Countries

| United States of America |

|

59.84% |

| Taiwan, Province Of China |

|

7.09% |

| China |

|

5.49% |

| Korea, Republic Of |

|

5.49% |

| Global |

|

5.39% |

| Japan |

|

4.10% |

| United Kingdom |

|

3.90% |

| Germany |

|

3.40% |

| Sweden |

|

2.80% |

| Netherlands |

|

2.50% |

Branches

| IT |

|

58.00% |

| Telecommunication Services |

|

12.40% |

| Consumer goods, cyclical |

|

10.30% |

| Industry |

|

7.50% |

| Finance |

|

6.30% |

| Cash |

|

2.50% |

| real estate |

|

1.50% |

| Energy |

|

1.40% |

| Basic Consumer Goods |

|

0.10% |