J.Henderson Gl.Real Est.Eq.IF.H1q

IE00B9520L40

J.Henderson Gl.Real Est.Eq.IF.H1q/ IE00B9520L40 /

| NAV2024-10-30 |

Chg.+0.0300 |

Type of yield |

Investment Focus |

Investment company |

| 12.2500GBP |

+0.25% |

paying dividend |

Real Estate

Worldwide

|

Janus Henderson Inv. ▶ |

Investment goal

A REIT (Real Estate Investment Trust) is a company that owns, and in most cases operates various income-producing commercial real estate properties.The Fund seeks total return through a combination of capital appreciation and current income. It invests primarily in REITs of US issuers which may include small capitalisation stocks.

Master data

| Type of yield: |

paying dividend |

| Funds Category: |

Real Estate |

| Region: |

Worldwide |

| Branch: |

Real Estate Fund/Equity |

| Benchmark: |

FTSE EPRA Nareit Global REIT Index |

| Business year start: |

01-01 |

| Last Distribution: |

2024-08-15 |

| Depository bank: |

J.P. Morgan SE Dublin Branch |

| Fund domicile: |

Ireland |

| Distribution permission: |

Germany, Switzerland, Czech Republic |

| Fund manager: |

Guy Barnard, Tim Gibson, Greg Kuhl |

| Fund volume: |

222.59 mill.

USD

|

| Launch date: |

2014-06-29 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

0.00% |

| Max. Administration Fee: |

0.80% |

| Minimum investment: |

2,500.00 GBP |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Janus Henderson Inv. |

| Address: |

201 Bishopsgate, EC2M 3AE, London |

| Country: |

United Kingdom |

| Internet: |

www.janushenderson.com/

|

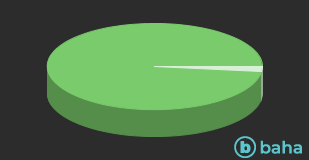

Assets

| Real Estate |

|

98.11% |

| Cash |

|

1.89% |

Countries

| United States of America |

|

70.52% |

| Australia |

|

6.93% |

| Japan |

|

5.35% |

| United Kingdom |

|

3.53% |

| Singapore |

|

2.80% |

| Canada |

|

2.11% |

| Cash |

|

1.89% |

| Spain |

|

1.31% |

| Hong Kong, SAR of China |

|

1.20% |

| Netherlands |

|

1.09% |

| Belgium |

|

0.94% |

| Cayman Islands |

|

0.90% |

| France |

|

0.49% |

| Germany |

|

0.44% |

| Others |

|

0.50% |

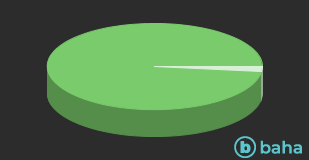

Branches

| real estate |

|

98.11% |

| Cash |

|

1.89% |