BGF World Financials F.A2 HKD H

LU1791807156

BGF World Financials F.A2 HKD H/ LU1791807156 /

| NAV17/06/2024 |

Var.+0.9600 |

Type of yield |

Focus sugli investimenti |

Società d'investimento |

| 149.2400HKD |

+0.65% |

reinvestment |

Equity

Worldwide

|

BlackRock (LU) ▶ |

Investment strategy

The Fund aims to maximise the return on your investment through a combination of capital growth and income on the Fund"s assets and invest in a manner consistent with the principles of environmental, social and governance (ESG) investing. The Fund invests globally at least 70% of its total assets in the equity securities (e.g. shares) of companies the main business of which is financial services. The Fund"s total assets will be invested in accordance with its ESG Policy as disclosed in the prospectus. For further details regarding the ESG characteristics please refer to the prospectus and the BlackRock website at www.blackrock.com/baselinescreens

The investment adviser (IA) may use financial derivative instruments (FDIs) (i.e. investments the prices of which are based on one or more underlying assets) for investment purposes in order to achieve the investment objective of the Fund, and/or to reduce risk within the Fund"s portfolio, reduce investment costs and generate additional income. The Fund may, via FDIs, generate varying amounts of market leverage (i.e. where the Fund gains market exposure in excess of the value of its assets). The Fund is actively managed, and the IA has discretion to select the Fund's investments. In doing so, the IA will refer to the MSCI ACWI Financials Index (the "Index") when constructing the Fund"s portfolio, and also for risk management purposes to ensure that the active risk (i.e. degree of deviation from the Index) taken by the Fund remains appropriate given the Fund"s investment objective and policy. The IA is not bound by the components or weighting of the Index when selecting investments. The IA may also use its discretion to invest in securities not included in the Index in order to take advantage of specific investment opportunities. However, the sector requirements of the investment objective and policy may have the effect of limiting the extent to which the portfolio holdings will deviate from the Index. The Index should be used by investors to compare the performance of the Fund.

Investment goal

The Fund aims to maximise the return on your investment through a combination of capital growth and income on the Fund"s assets and invest in a manner consistent with the principles of environmental, social and governance (ESG) investing. The Fund invests globally at least 70% of its total assets in the equity securities (e.g. shares) of companies the main business of which is financial services. The Fund"s total assets will be invested in accordance with its ESG Policy as disclosed in the prospectus. For further details regarding the ESG characteristics please refer to the prospectus and the BlackRock website at www.blackrock.com/baselinescreens

Dati master

| Type of yield: |

reinvestment |

| Fondi Categoria: |

Equity |

| Region: |

Worldwide |

| Settore: |

Sector Finance |

| Benchmark: |

MSCI ACWI Financials Index |

| Business year start: |

01/09 |

| Ultima distribuzione: |

- |

| Banca depositaria: |

The Bank of New York Mellon SA/NV, Zweigniederlassung Luxemburg |

| Domicilio del fondo: |

Luxembourg |

| Permesso di distribuzione: |

Austria, Germany, Switzerland |

| Gestore del fondo: |

Vasco Moreno |

| Volume del fondo: |

1.53 bill.

USD

|

| Data di lancio: |

04/04/2018 |

| Investment focus: |

- |

Condizioni

| Sovrapprezzo emissione: |

5.00% |

| Tassa amministrativa massima: |

1.50% |

| Investimento minimo: |

5,000.00 HKD |

| Deposit fees: |

0.45% |

| Redemption charge: |

0.00% |

| Prospetto semplificato: |

Download (Print version) |

Società d'investimento

| Funds company: |

BlackRock (LU) |

| Indirizzo: |

35a Avenue JF Kennedy, 1855, Luxemburg |

| Paese: |

Luxembourg |

| Internet: |

www.blackrock.com

|

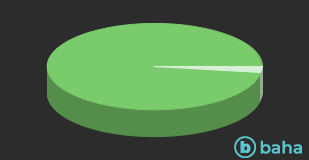

Attività

| Stocks |

|

97.73% |

| Mutual Funds |

|

2.27% |

Paesi

| United States of America |

|

46.78% |

| United Kingdom |

|

9.64% |

| Italy |

|

4.62% |

| Germany |

|

4.45% |

| Austria |

|

3.81% |

| Switzerland |

|

3.74% |

| Brazil |

|

3.15% |

| Kazakhstan |

|

2.62% |

| Bermuda |

|

2.42% |

| Spain |

|

2.14% |

| Turkey |

|

2.05% |

| India |

|

2.01% |

| Portugal |

|

1.77% |

| France |

|

1.76% |

| Philippines |

|

1.72% |

| Altri |

|

7.32% |

Filiali

| Bank |

|

44.68% |

| Financial Services |

|

12.42% |

| IT Services |

|

9.16% |

| Investment Banking/Brokerage |

|

8.55% |

| Asset Management |

|

8.31% |

| Investment firm |

|

2.81% |

| insurance |

|

2.53% |

| Reinsurer |

|

2.42% |

| Housing Construction |

|

1.87% |

| Software |

|

1.82% |

| Savings Bank |

|

1.04% |

| Altri |

|

4.39% |