Amundi Fds.Euroland Eq.I2 GBP

LU1897304546

Amundi Fds.Euroland Eq.I2 GBP/ LU1897304546 /

| NAV2024-04-30 |

Chg.-10.5100 |

Type of yield |

Investment Focus |

Investment company |

| 1,582.0200GBP |

-0.66% |

reinvestment |

Equity

Euroland

|

Amundi Luxembourg ▶ |

Investment strategy

Seeks to increase the value of your investment (mainly through capital growth), and outperform the benchmark, over the recommended holding period, while achieving a ESG score greater than that of the benchmark.

The sub-fund is actively managed. It extensively invests in equities of companies in the eurozone.The sub-fund may or may not hedge currency risk at portfolio level, at the discretion of the investment manager.The sub-fund uses derivatives to reduce various risks (hedging), manage the portfolio more efficiently, and gain exposure (long or short) to various assets, markets or other investment opportunities such as equities and foreign exchange.

Investment goal

Seeks to increase the value of your investment (mainly through capital growth), and outperform the benchmark, over the recommended holding period, while achieving a ESG score greater than that of the benchmark.

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Equity |

| Region: |

Euroland |

| Branch: |

Mixed Sectors |

| Benchmark: |

MSCI EMU |

| Business year start: |

07-01 |

| Last Distribution: |

- |

| Depository bank: |

CACEIS Bank, Luxembourg Branch |

| Fund domicile: |

Luxembourg |

| Distribution permission: |

Austria, Germany, Switzerland, Luxembourg |

| Fund manager: |

Di Giansante Fabio |

| Fund volume: |

5.28 bill.

EUR

|

| Launch date: |

2019-06-07 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

0.00% |

| Max. Administration Fee: |

0.60% |

| Minimum investment: |

5,000,000.00 GBP |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Amundi Luxembourg |

| Address: |

5 allée Scheffer, L-2520, Luxemburg |

| Country: |

Luxembourg |

| Internet: |

www.amundi.lu

|

Assets

| Stocks |

|

99.43% |

| Money Market |

|

0.44% |

| Cash |

|

0.13% |

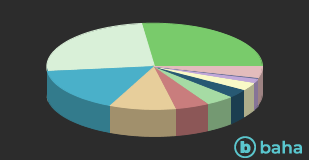

Countries

| France |

|

26.88% |

| Germany |

|

24.90% |

| Netherlands |

|

16.46% |

| United States of America |

|

9.99% |

| Spain |

|

5.08% |

| Italy |

|

4.35% |

| United Kingdom |

|

3.15% |

| Belgium |

|

3.05% |

| Ireland |

|

1.82% |

| Cash |

|

0.13% |

| Others |

|

4.19% |

Branches

| Finance |

|

18.03% |

| Industry |

|

17.00% |

| Consumer goods, cyclical |

|

13.22% |

| Basic Consumer Goods |

|

11.57% |

| IT |

|

10.52% |

| Healthcare |

|

8.52% |

| Energy |

|

5.98% |

| Utilities |

|

5.88% |

| Commodities |

|

5.28% |

| Telecommunication Services |

|

3.43% |

| Cash |

|

0.13% |

| Others |

|

0.44% |