AGIF-Allianz Global Water AT3 CHF

LU2229751586

AGIF-Allianz Global Water AT3 CHF/ LU2229751586 /

| NAV2024-04-26 |

Chg.+1.9500 |

Type of yield |

Investment Focus |

Investment company |

| 133.3000CHF |

+1.48% |

reinvestment |

Equity

Worldwide

|

Allianz Gl.Investors ▶ |

Investment strategy

Long-term capital growth by investing in global Equity Markets with a focus on companies with an engagement in the area of water resource management in accordance with the SDGAligned Strategy. The Sub-Fund follows the SDG-Aligned Strategy and focuses on companies providing solutions that create positive environmental and social outcomes via their contribution to one or more of the SDGs with simultaneous application of certain minimum exclusion criteria for direct investments.

Min. 70% of Sub-Fund assets are invested in companies with an engagement in the area of water resource management in accordance with the SDG-Aligned Strategy. Companies which engage in the area of water resource management are companies which offer products and/or services that create positive environmental and social outcomes along water scarcity and quality issues and helps to improve the sustainability of global water resources. Sub-Fund assets may be - even completely - invested in Emerging Markets. Max. 30% of Sub- Fund assets may be invested in Equities other than described in the investment objective in accordance with the SDG-Aligned Strategy. Max. 10% of Sub-Fund assets may be invested in the China A-Shares Markets. Max. 30% of Sub Fund assets may be held in time deposits and/or (up to 20% of Sub-Fund assets) in deposits at sight and/or invested in Money Market Instruments and/or (up to 10% of Sub-Fund assets) in money market funds for liquidity management. Max. 10% of Sub-Fund assets may be invested in UCITS and/or UCI. All bonds and money market instruments must have at the time of acquisition a rating of at least B- or a comparable rating from a recognised rating agency.Sub-Fund classifies as "equity-fund" according to German Investment Tax Act (GITA).

Investment goal

Long-term capital growth by investing in global Equity Markets with a focus on companies with an engagement in the area of water resource management in accordance with the SDGAligned Strategy. The Sub-Fund follows the SDG-Aligned Strategy and focuses on companies providing solutions that create positive environmental and social outcomes via their contribution to one or more of the SDGs with simultaneous application of certain minimum exclusion criteria for direct investments.

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Equity |

| Region: |

Worldwide |

| Branch: |

Sector Utility |

| Benchmark: |

MSCI AC World (ACWI) Total Return Net (in EUR) |

| Business year start: |

10-01 |

| Last Distribution: |

- |

| Depository bank: |

State Street Bank International GmbH - Luxembourg Branch |

| Fund domicile: |

Luxembourg |

| Distribution permission: |

Austria, Germany, Switzerland, Luxembourg |

| Fund manager: |

Andreas Fruschki |

| Fund volume: |

1.13 bill.

EUR

|

| Launch date: |

2020-10-01 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

5.00% |

| Max. Administration Fee: |

1.28% |

| Minimum investment: |

75,000.00 CHF |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Allianz Gl.Investors |

| Address: |

Bockenheimer Landstraße 42-44, 60323, Frankfurt am Main |

| Country: |

Germany |

| Internet: |

www.allianzgi.com

|

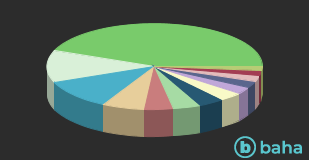

Countries

| United States of America |

|

44.08% |

| United Kingdom |

|

12.03% |

| Switzerland |

|

11.10% |

| Japan |

|

6.32% |

| Ireland |

|

4.35% |

| Canada |

|

4.12% |

| France |

|

3.88% |

| Cash |

|

3.54% |

| Denmark |

|

2.58% |

| Austria |

|

2.45% |

| Netherlands |

|

2.17% |

| Germany |

|

1.97% |

| Sweden |

|

1.41% |

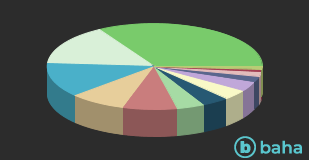

Branches

| Industrial facilities |

|

33.57% |

| Baumaterialien/Baukomponenten |

|

15.36% |

| waste service |

|

12.91% |

| wholesale and retail sector |

|

8.44% |

| Special chemicals |

|

8.19% |

| IT hardware |

|

4.16% |

| various sectors |

|

4.12% |

| utilities |

|

3.88% |

| Cash |

|

3.54% |

| Construction |

|

2.17% |

| Maschinenbau Landwirtschaft |

|

1.72% |

| water |

|

0.93% |

| Others |

|

1.01% |