UBS (Lux) Money Market Fund - EUR, Anteilsklasse P-acc, EUR

LU0006344922

UBS (Lux) Money Market Fund - EUR, Anteilsklasse P-acc, EUR/ LU0006344922 /

| NAV13/05/2024 |

Chg.+0.2000 |

Type de rendement |

Focus sur l'investissement |

Société de fonds |

| 845.3400EUR |

+0.02% |

reinvestment |

Money Market

Worldwide

|

UBS Fund M. (LU) ▶ |

Stratégie d'investissement

The actively managed sub-fund is a standard VNAV money market fund within the meaning of the EU Money Market Fund Regulation and invests exclusively in diversified, high-quality money market instruments with first-class borrower credit ratings. The weighted average maturity of the securities held in the portfolio may not exceed 6 months, while the final maturity of a fixed-income investment may not exceed 1 year. The sub-fund is suitable for investors who wish to invest in a portfolio that generates long-term performance and is in line with the prevailing money market indices. This sub-fund promotes environmental and/or social characteristics but does not pursue a sustainable investment objective.

In constructing the portfolio, the investment manager focuses on capital preservation and liquidity combined with generating attractive returns while maintaining a conservative risk profile. The actively managed sub-fund uses the benchmark FTSE EUR 3M Eurodeposits as a reference for performance comparison. In times of high market volatility, the performance of the subfund can deviate significantly from the benchmark. The return of the fund depends primarily on the development of interest rates, the creditworthiness of issuers and interest income.

Objectif d'investissement

The actively managed sub-fund is a standard VNAV money market fund within the meaning of the EU Money Market Fund Regulation and invests exclusively in diversified, high-quality money market instruments with first-class borrower credit ratings. The weighted average maturity of the securities held in the portfolio may not exceed 6 months, while the final maturity of a fixed-income investment may not exceed 1 year. The sub-fund is suitable for investors who wish to invest in a portfolio that generates long-term performance and is in line with the prevailing money market indices. This sub-fund promotes environmental and/or social characteristics but does not pursue a sustainable investment objective.

Opérations

| Type de rendement: |

reinvestment |

| Fonds Catégorie: |

Money Market |

| Région de placement: |

Worldwide |

| Branche: |

Money Market Securities |

| Benchmark: |

FTSE EUR 3M Eurodeposits |

| Début de l'exercice: |

01/11 |

| Dernière distribution: |

- |

| Banque dépositaire: |

UBS Europe SE, Luxembourg Branch |

| Domicile: |

Luxembourg |

| Permission de distribution: |

Austria, Germany, Switzerland, United Kingdom |

| Gestionnaire du fonds: |

Leonardo Brenna,Robbie Taylor,Zieshan Afzal |

| Actif net: |

2.62 Mrd.

EUR

|

| Date de lancement: |

09/10/1989 |

| Focus de l'investissement: |

- |

Conditions

| Surtaxe d'émission: |

3.00% |

| Frais d'administration max.: |

0.40% |

| Investissement minimum: |

- EUR |

| Deposit fees: |

- |

| Frais de rachat: |

0.00% |

| Prospectus simplifié: |

Télécharger (Version imprimée) |

Société de fonds

| Société de fonds: |

UBS Fund M. (LU) |

| Adresse: |

33A avenue J.F. Kennedy, 1855, Luxembourg |

| Pays: |

Luxembourg |

| Internet: |

www.ubs.com

|

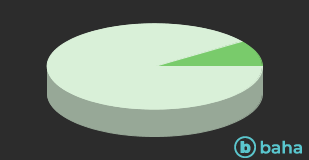

Pays

| Global |

|

10.00% |

| Autres |

|

90.00% |