UBS(Irl)Sel.Mon.Mkt.Fd.EUR Cap.

IE00BWWCQY35

UBS(Irl)Sel.Mon.Mkt.Fd.EUR Cap./ IE00BWWCQY35 /

| Стоимость чистых активов07.05.2024 |

Изменение0.0000 |

Тип доходности |

Инвестиционная направленность |

Инвестиционная компания |

| 1.0000EUR |

0.00% |

paying dividend |

Money Market

Worldwide

|

UBS Fund M. (LU) ▶ |

Инвестиционная стратегия

The actively managed fund invests in high quality, short-term debt securities issued in Euro (EUR) by EU and non-EU issuers including governments, banks, and corporations and other businesses. The fund will maintain a weighted average maturity of no more than 60 days and a weighted average life of no more than 120 days. The fund aims to earn maximum current income while seeking to preserve the amount invested and maintaining the ability to withdraw the investment.

The fund is a Low Volatility Net Asset Value money market fund as defined in the EU Money Market Fund Regulation. This means that the fund generally invests in short-term debt obligations and similar securities that can be easily bought and sold. The fund may only invest in securities that it determines present minimal credit risks, are 'first tier securities' and which are rated high quality (i.e. meet a specified level of credit worthiness) at the time of purchase. This sub-fund promotes environmental and/or social characteristics but does not have a sustainable investment objective. The fund is actively managed in reference to the ESTR Index - Euro Short-term Rate. The benchmark is only used for performance comparison. The return of the fund depends primarily on the development of interest rates and creditworthiness of the issuers as well as the interest income.

Инвестиционная цель

The actively managed fund invests in high quality, short-term debt securities issued in Euro (EUR) by EU and non-EU issuers including governments, banks, and corporations and other businesses. The fund will maintain a weighted average maturity of no more than 60 days and a weighted average life of no more than 120 days. The fund aims to earn maximum current income while seeking to preserve the amount invested and maintaining the ability to withdraw the investment.

Основные данные

| Тип доходности: |

paying dividend |

| Категории фондов: |

Money Market |

| Регион: |

Worldwide |

| Branch: |

Money Market Securities |

| Бенчмарк: |

ESTR Index - Euro Short-term Rate |

| Начало рабочего (бизнес) года: |

01.09 |

| Last Distribution: |

03.05.2024 |

| Депозитарный банк: |

State Street Cust. Serv. (Ireland) Limited |

| Место жительства фонда: |

Ireland |

| Разрешение на распространение: |

Austria, Germany, Switzerland |

| Управляющий фондом: |

Robbie Taylor, Leonardo Brenna, Zieshan Afzal |

| Объем фонда: |

1.14 млрд

EUR

|

| Дата запуска: |

28.06.2018 |

| Инвестиционная направленность: |

- |

Условия

| Эмиссионная надбавка: |

0.00% |

| Max. Administration Fee: |

0.00% |

| Минимальное вложение: |

500,000.00 EUR |

| Deposit fees: |

- |

| Комиссионные, взимаемые фондами взаимных инвестиций при погашении акций: |

0.00% |

| Упрощенный проспект: |

Скачать (Версия для печати) |

Инвестиционная компания

| Товарищества на вере: |

UBS Fund M. (LU) |

| Адрес: |

33A avenue J.F. Kennedy, 1855, Luxembourg |

| Страна: |

Luxembourg |

| Интернет: |

www.ubs.com

|

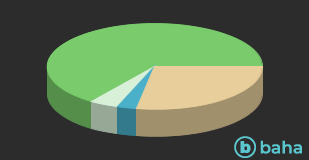

Активы

| Money Market |

|

65.00% |

| Cash |

|

4.40% |

| Bonds |

|

2.90% |

| Другие |

|

27.70% |