UBS(Irl)Sel.Mon.Mkt.Fd.EUR Cap.

IE00BWWCQY35

UBS(Irl)Sel.Mon.Mkt.Fd.EUR Cap./ IE00BWWCQY35 /

| NAV08/05/2024 |

Diferencia0.0000 |

Tipo de beneficio |

Enfoque de la inversión |

Sociedad de fondos |

| 1.0000EUR |

0.00% |

paying dividend |

Money Market

Worldwide

|

UBS Fund M. (LU) ▶ |

Estrategia de inversión

The actively managed fund invests in high quality, short-term debt securities issued in Euro (EUR) by EU and non-EU issuers including governments, banks, and corporations and other businesses. The fund will maintain a weighted average maturity of no more than 60 days and a weighted average life of no more than 120 days. The fund aims to earn maximum current income while seeking to preserve the amount invested and maintaining the ability to withdraw the investment.

The fund is a Low Volatility Net Asset Value money market fund as defined in the EU Money Market Fund Regulation. This means that the fund generally invests in short-term debt obligations and similar securities that can be easily bought and sold. The fund may only invest in securities that it determines present minimal credit risks, are 'first tier securities' and which are rated high quality (i.e. meet a specified level of credit worthiness) at the time of purchase. This sub-fund promotes environmental and/or social characteristics but does not have a sustainable investment objective. The fund is actively managed in reference to the ESTR Index - Euro Short-term Rate. The benchmark is only used for performance comparison. The return of the fund depends primarily on the development of interest rates and creditworthiness of the issuers as well as the interest income.

Objetivo de inversión

The actively managed fund invests in high quality, short-term debt securities issued in Euro (EUR) by EU and non-EU issuers including governments, banks, and corporations and other businesses. The fund will maintain a weighted average maturity of no more than 60 days and a weighted average life of no more than 120 days. The fund aims to earn maximum current income while seeking to preserve the amount invested and maintaining the ability to withdraw the investment.

Datos maestros

| Tipo de beneficio: |

paying dividend |

| Categoría de fondos: |

Money Market |

| Región: |

Worldwide |

| Sucursal: |

Money Market Securities |

| Punto de referencia: |

ESTR Index - Euro Short-term Rate |

| Inicio del año fiscal: |

01/09 |

| Última distribución: |

03/05/2024 |

| Banco depositario: |

State Street Cust. Serv. (Ireland) Limited |

| País de origen: |

Ireland |

| Permiso de distribución: |

Austria, Germany, Switzerland |

| Gestor de fondo: |

Robbie Taylor, Leonardo Brenna, Zieshan Afzal |

| Volumen de fondo: |

1.14 mil millones

EUR

|

| Fecha de fundación: |

28/06/2018 |

| Enfoque de la inversión: |

- |

Condiciones

| Recargo de emisión: |

0.00% |

| Max. Comisión de administración: |

0.00% |

| Inversión mínima: |

500,000.00 EUR |

| Deposit fees: |

- |

| Cargo por amortización: |

0.00% |

| Prospecto simplificado: |

Descargar (Versión para imprimir) |

Sociedad de fondos

| Fondos de empresa: |

UBS Fund M. (LU) |

| Dirección: |

33A avenue J.F. Kennedy, 1855, Luxembourg |

| País: |

Luxembourg |

| Internet: |

www.ubs.com

|

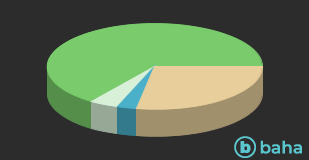

Activos

| Money Market |

|

65.00% |

| Cash |

|

4.40% |

| Bonds |

|

2.90% |

| Otros |

|

27.70% |