Franklin Templeton Investment Funds Templeton Global Total Return Fund Klasse A (acc) USD

LU0170475312

Franklin Templeton Investment Funds Templeton Global Total Return Fund Klasse A (acc) USD/ LU0170475312 /

| NAV02/05/2024 |

Var.+0.3300 |

Type of yield |

Focus sugli investimenti |

Società d'investimento |

| 23.9200USD |

+1.40% |

reinvestment |

Bonds

Worldwide

|

Franklin Templeton ▶ |

Investment strategy

The Fund aims to maximise total investment return by achieving an increase in the value of its investments, earning income and realising currency gains over the medium to long term.

The Fund pursues an actively managed investment strategy and invests mainly in: - debt securities of any quality (including lower quality debt such as non- investment grade securities) issued by governments, government-related or corporate entities in any developed or emerging markets The Fund can invest to a lesser extent in: - mortgage- and asset-backed securities - debt securities of supranational entities, such as the European Investment Bank - Mainland China through the Bond Connect or directly (less than 30% of assets) - securities in default (limited to 10% of assets) - units of other mutual funds (limited to 10% of assets) The Fund can use derivatives for hedging, efficient portfolio management and/or investment purposes which are used as an active investment management instrument to gain exposure to markets. The flexible and opportunistic nature of the strategy allows the investment team to take advantage of different market environments. In making investment decisions, the investment team uses in-depth research about various factors that may affect bond prices and currency values. The Fund may hold significant amounts of bank deposits, money market instruments or money market funds due to the use of derivatives or in order to achieve its investment goals and for treasury purposes. The benchmark of the Fund is the Bloomberg Multiverse Index. The benchmark is used solely as a reference for Investors to compare against the Fund's performance, and the benchmark is neither used as a constraint on how the Fund's portfolio is to be constructed nor set as a target for the Fund's performance to beat. The Fund can deviate from the benchmark.

Investment goal

The Fund aims to maximise total investment return by achieving an increase in the value of its investments, earning income and realising currency gains over the medium to long term.

Dati master

| Type of yield: |

reinvestment |

| Fondi Categoria: |

Bonds |

| Region: |

Worldwide |

| Settore: |

Bonds: Mixed |

| Benchmark: |

Bloomberg Multiverse Index |

| Business year start: |

01/07 |

| Ultima distribuzione: |

- |

| Banca depositaria: |

J.P. Morgan SE, Niederlassung Luxemburg |

| Domicilio del fondo: |

Luxembourg |

| Permesso di distribuzione: |

Austria, Germany, Switzerland, United Kingdom, Luxembourg |

| Gestore del fondo: |

Michael Hasenstab, Calvin Ho |

| Volume del fondo: |

2.19 bill.

USD

|

| Data di lancio: |

29/08/2003 |

| Investment focus: |

- |

Condizioni

| Sovrapprezzo emissione: |

5.00% |

| Tassa amministrativa massima: |

1.05% |

| Investimento minimo: |

1,000.00 USD |

| Deposit fees: |

0.14% |

| Redemption charge: |

0.00% |

| Prospetto semplificato: |

Download (Print version) |

Società d'investimento

| Funds company: |

Franklin Templeton |

| Indirizzo: |

Schottenring 16, 2.OG, 1010, Wien |

| Paese: |

Austria |

| Internet: |

www.franklintempleton.at

|

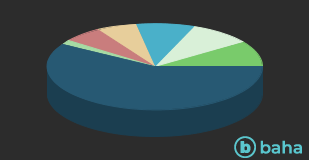

Paesi

| Malaysia |

|

9.72% |

| Brazil |

|

9.34% |

| Indonesia |

|

8.72% |

| Cash |

|

6.05% |

| United States of America |

|

5.90% |

| Japan |

|

1.56% |

| Altri |

|

58.71% |