PrivilEdge - Fidelity Technology, Syst. Hdg, (EUR) MD

LU1390459128

PrivilEdge - Fidelity Technology, Syst. Hdg, (EUR) MD/ LU1390459128 /

| NAV30/05/2024 |

Chg.-0.4147 |

Type de rendement |

Focus sur l'investissement |

Société de fonds |

| 53.0514EUR |

-0.78% |

paying dividend |

Equity

Worldwide

|

Lombard Odier F.(EU) ▶ |

Stratégie d'investissement

The Sub-Fund is actively managed in reference to a benchmark. The MSCI AC Information Technology USD (the "Benchmark") is used for performance comparison and for internal risk monitoring purposes only, without implying any particular constraints to the Sub-Fund's investments.

The Sub-Fund"s securities will generally be similar to those of the Benchmark but the security weightings are expected to differ materially. The Investment Manager may also select securities not included in the Benchmark in order to take advantage of investment opportunities. The Sub-Fund aims to generate capital growth over the long term with a level of income expected to be low. It mainly invests in shares issued by companies worldwide that will provide or benefit from technological advances and improvements in relation to products, processes or services. Even if a large part of the underlying shares will be incorparated in North America or Europe, the Investment Manager keep his freedom to invest outside these countries, like in Asia and in other Emerging Markets.

Objectif d'investissement

The Sub-Fund is actively managed in reference to a benchmark. The MSCI AC Information Technology USD (the "Benchmark") is used for performance comparison and for internal risk monitoring purposes only, without implying any particular constraints to the Sub-Fund's investments.

Opérations

| Type de rendement: |

paying dividend |

| Fonds Catégorie: |

Equity |

| Région de placement: |

Worldwide |

| Branche: |

Sector Technology |

| Benchmark: |

MSCI AC Information Technology USD |

| Début de l'exercice: |

01/10 |

| Dernière distribution: |

- |

| Banque dépositaire: |

CACEIS Bank, Luxembourg Branch |

| Domicile: |

Luxembourg |

| Permission de distribution: |

Austria, Germany, Switzerland |

| Gestionnaire du fonds: |

Fidelity International Limited |

| Actif net: |

675.12 Mio.

USD

|

| Date de lancement: |

24/08/2017 |

| Focus de l'investissement: |

- |

Conditions

| Surtaxe d'émission: |

5.00% |

| Frais d'administration max.: |

0.80% |

| Investissement minimum: |

3,000.00 EUR |

| Deposit fees: |

- |

| Frais de rachat: |

0.00% |

| Prospectus simplifié: |

- |

Société de fonds

| Société de fonds: |

Lombard Odier F.(EU) |

| Adresse: |

291, route d'Arlon, L-1150, Luxembourg |

| Pays: |

Luxembourg |

| Internet: |

www.lombardodier.com

|

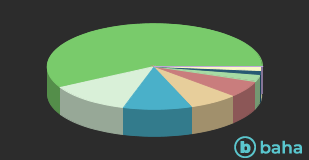

Pays

| United States of America |

|

59.84% |

| Taiwan, Province Of China |

|

7.09% |

| China |

|

5.49% |

| Korea, Republic Of |

|

5.49% |

| Global |

|

5.39% |

| Japan |

|

4.10% |

| United Kingdom |

|

3.90% |

| Germany |

|

3.40% |

| Sweden |

|

2.80% |

| Netherlands |

|

2.50% |

Branches

| IT |

|

58.00% |

| Telecommunication Services |

|

12.40% |

| Consumer goods, cyclical |

|

10.30% |

| Industry |

|

7.50% |

| Finance |

|

6.30% |

| Cash |

|

2.50% |

| real estate |

|

1.50% |

| Energy |

|

1.40% |

| Basic Consumer Goods |

|

0.10% |