PrivilEdge - Fidelity Technology, Syst. Hdg, (EUR) MD

LU1390459128

PrivilEdge - Fidelity Technology, Syst. Hdg, (EUR) MD/ LU1390459128 /

| NAV30/05/2024 |

Diferencia-0.4147 |

Tipo de beneficio |

Enfoque de la inversión |

Sociedad de fondos |

| 53.0514EUR |

-0.78% |

paying dividend |

Equity

Worldwide

|

Lombard Odier F.(EU) ▶ |

Estrategia de inversión

The Sub-Fund is actively managed in reference to a benchmark. The MSCI AC Information Technology USD (the "Benchmark") is used for performance comparison and for internal risk monitoring purposes only, without implying any particular constraints to the Sub-Fund's investments.

The Sub-Fund"s securities will generally be similar to those of the Benchmark but the security weightings are expected to differ materially. The Investment Manager may also select securities not included in the Benchmark in order to take advantage of investment opportunities. The Sub-Fund aims to generate capital growth over the long term with a level of income expected to be low. It mainly invests in shares issued by companies worldwide that will provide or benefit from technological advances and improvements in relation to products, processes or services. Even if a large part of the underlying shares will be incorparated in North America or Europe, the Investment Manager keep his freedom to invest outside these countries, like in Asia and in other Emerging Markets.

Objetivo de inversión

The Sub-Fund is actively managed in reference to a benchmark. The MSCI AC Information Technology USD (the "Benchmark") is used for performance comparison and for internal risk monitoring purposes only, without implying any particular constraints to the Sub-Fund's investments.

Datos maestros

| Tipo de beneficio: |

paying dividend |

| Categoría de fondos: |

Equity |

| Región: |

Worldwide |

| Sucursal: |

Sector Technology |

| Punto de referencia: |

MSCI AC Information Technology USD |

| Inicio del año fiscal: |

01/10 |

| Última distribución: |

- |

| Banco depositario: |

CACEIS Bank, Luxembourg Branch |

| País de origen: |

Luxembourg |

| Permiso de distribución: |

Austria, Germany, Switzerland |

| Gestor de fondo: |

Fidelity International Limited |

| Volumen de fondo: |

675.12 millones

USD

|

| Fecha de fundación: |

24/08/2017 |

| Enfoque de la inversión: |

- |

Condiciones

| Recargo de emisión: |

5.00% |

| Max. Comisión de administración: |

0.80% |

| Inversión mínima: |

3,000.00 EUR |

| Deposit fees: |

- |

| Cargo por amortización: |

0.00% |

| Prospecto simplificado: |

- |

Sociedad de fondos

| Fondos de empresa: |

Lombard Odier F.(EU) |

| Dirección: |

291, route d'Arlon, L-1150, Luxembourg |

| País: |

Luxembourg |

| Internet: |

www.lombardodier.com

|

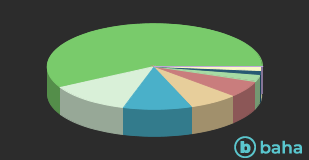

Países

| United States of America |

|

59.84% |

| Taiwan, Province Of China |

|

7.09% |

| China |

|

5.49% |

| Korea, Republic Of |

|

5.49% |

| Global |

|

5.39% |

| Japan |

|

4.10% |

| United Kingdom |

|

3.90% |

| Germany |

|

3.40% |

| Sweden |

|

2.80% |

| Netherlands |

|

2.50% |

Sucursales

| IT |

|

58.00% |

| Telecommunication Services |

|

12.40% |

| Consumer goods, cyclical |

|

10.30% |

| Industry |

|

7.50% |

| Finance |

|

6.30% |

| Cash |

|

2.50% |

| real estate |

|

1.50% |

| Energy |

|

1.40% |

| Basic Consumer Goods |

|

0.10% |