Pareto SICAV Par.Nord.C.Bd.I EUR H

LU1732224917

Pareto SICAV Par.Nord.C.Bd.I EUR H/ LU1732224917 /

| NAV05.06.2024 |

Zm.-0,0057 |

Typ dystrybucji dochodów |

Kategoria |

Firma inwestycyjna |

| 125,7727EUR |

0,00% |

z reinwestycją |

Obligacje

Skandynawia

|

FundRock M. Co. ▶ |

Strategia inwestycyjna

The sub-fund aims to achieve the best possible return, relative to the risk taken by the sub-fund. The sub-fund invests in fixed income and fixed income related securities issued by corporations, agencies, governments and municipalities. The debt securities may include subordinated, hybrids and convertible bonds. Investments are expected to give the sub-fund a higher risk and return than traditional securities due to a higher credit risk. The sub-fund primarily invests in securities issued by companies domiciled or with a presence in the Nordic region. The average interest rate duration of the sub-fund"s portfolio shall be between 0 and 4 years.

The sub-fund may not invest more than 10% of its assets in other investment funds. The sub-fund invests in derivatives to achieve its investment objective or to reduce risks. The sub-fund qualifies as an Article 8 financial product under SFDR since its investment policy contains broad environmental social, and governance consideration.

Cel inwestycyjny

The sub-fund aims to achieve the best possible return, relative to the risk taken by the sub-fund. The sub-fund invests in fixed income and fixed income related securities issued by corporations, agencies, governments and municipalities. The debt securities may include subordinated, hybrids and convertible bonds. Investments are expected to give the sub-fund a higher risk and return than traditional securities due to a higher credit risk. The sub-fund primarily invests in securities issued by companies domiciled or with a presence in the Nordic region. The average interest rate duration of the sub-fund"s portfolio shall be between 0 and 4 years.

Dane podstawowe

| Typ dystrybucji dochodów: |

z reinwestycją |

| Kategoria funduszy: |

Obligacje |

| Region: |

Skandynawia |

| Branża: |

Obligacje korporacyjne |

| Benchmark: |

- |

| Początek roku obrachunkowego: |

01.01 |

| Last Distribution: |

- |

| Bank depozytariusz: |

Skandinaviska Enskilda Banken S.A. |

| Kraj pochodzenia funduszu: |

Luxemburg |

| Zezwolenie na dystrybucję: |

Niemcy, Szwajcaria, Luxemburg |

| Zarządzający funduszem: |

Øyvind Hamre, Stefan Ericson, Thomas Larsen |

| Aktywa: |

- |

| Data startu: |

26.02.2018 |

| Koncentracja inwestycyjna: |

- |

Warunki

| Opłata za nabycie: |

0,50% |

| Max. Administration Fee: |

0,40% |

| Minimalna inwestycja: |

50 000 000,00 EUR |

| Opłaty depozytowe: |

0,01% |

| Opłata za odkupienie: |

0,50% |

| Uproszczony prospekt: |

Ściągnij (Wersja do wydruku) |

Firma inwestycyjna

| TFI: |

FundRock M. Co. |

| Adres: |

33 Rue de Gasperich, L-5826, Hesperange |

| Kraj: |

Luxemburg |

| Internet: |

www.fundrock.com

|

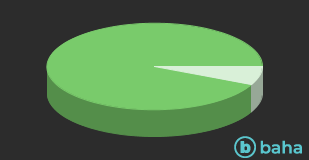

Aktywa

| Obligacje |

|

93,00% |

| Gotówka |

|

7,00% |

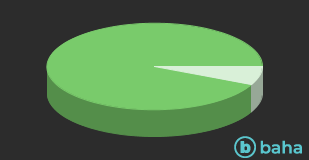

Kraje

| globalna |

|

93,00% |

| Gotówka |

|

7,00% |