Lazard Credit Opportunities RC EUR

FR0010230490

Lazard Credit Opportunities RC EUR/ FR0010230490 /

| NAV14/05/2024 |

Diferencia+0.0400 |

Tipo de beneficio |

Enfoque de la inversión |

Sociedad de fondos |

| 657.2800EUR |

+0.01% |

reinvestment |

Bonds

Worldwide

|

Lazard Fr. Gestion ▶ |

Estrategia de inversión

The management objective is to obtain, over the recommended investment period of 3 years, a performance net of fees higher than that of the reference indicator Ester Capitalisé + margin (from 1.25% to 2.40% depending on the units) for units expressed in Euro, Fed Funds + margin (1.25% to 2% depending on the units) for units expressed in USD and SARON + 2.40% for the unit expressed in CHF.

The strategy used to achieve this objective involves dynamic management of interest rate risk, credit risk and currency risk by investing primarily in risky debt issued by governments, companies, and financial institutions and structures. The Fund's modified duration will be managed dynamically within a range of -5 and +10. The Fund is invested as follows: Up to a maximum of 100% of the net assets in bonds and negotiable debt securities denominated in euros and/or any other currency, without any restriction in terms of credit quality. Up to a maximum of 60% of the net assets in bonds and negotiable debt securities denominated in currencies other than the euro and the US dollar. Up to a maximum of 10% of the net assets in UCITS and French or foreign AIF that comply with the four criteria set out in Article R.214-13 of the French monetary and financial code (Code monétaire et financier) and classified as money market, shortterm money market or bond funds. These UCIs may be managed by the management company. Up to a maximum of 5% of the net assets in ordinary shares deriving from debt restructuring. The fund manager will do their best to sell the shares received as soon as possible in the interest of the shareholders. Up to a maximum of 10% of the net assets in convertible bonds. Up to a maximum of 50% of the net assets in perpetual subordinated debt, including a maximum of 30% of the net assets in contingent convertible bonds (CoCos). Up to a maximum of 5% of the net assets in preference shares. As an exception to the 5%-10%-40% ratios, the management team may invest more than 35% of the UCI"s net assets in securities guaranteed by an EEA Member State or the United States.

Objetivo de inversión

The management objective is to obtain, over the recommended investment period of 3 years, a performance net of fees higher than that of the reference indicator Ester Capitalisé + margin (from 1.25% to 2.40% depending on the units) for units expressed in Euro, Fed Funds + margin (1.25% to 2% depending on the units) for units expressed in USD and SARON + 2.40% for the unit expressed in CHF.

Datos maestros

| Tipo de beneficio: |

reinvestment |

| Categoría de fondos: |

Bonds |

| Región: |

Worldwide |

| Sucursal: |

Bonds: Mixed |

| Punto de referencia: |

Ester Capitalisé + Marge (1,25% bis 2,40% je nach Anteil) |

| Inicio del año fiscal: |

01/10 |

| Última distribución: |

- |

| Banco depositario: |

CACEIS BANK |

| País de origen: |

France |

| Permiso de distribución: |

Austria, Germany, Switzerland |

| Gestor de fondo: |

Eleonore BUNEL |

| Volumen de fondo: |

1.35 mil millones

EUR

|

| Fecha de fundación: |

28/10/2005 |

| Enfoque de la inversión: |

- |

Condiciones

| Recargo de emisión: |

4.00% |

| Max. Comisión de administración: |

1.61% |

| Inversión mínima: |

1.00 EUR |

| Deposit fees: |

- |

| Cargo por amortización: |

0.00% |

| Prospecto simplificado: |

Descargar (Versión para imprimir) |

Sociedad de fondos

| Fondos de empresa: |

Lazard Fr. Gestion |

| Dirección: |

Avenue Louise 326, 1050, Bruxelles |

| País: |

Belgium |

| Internet: |

www.lazard.com

|

Activos

| Bonds |

|

94.00% |

| Cash and Other Assets |

|

6.00% |

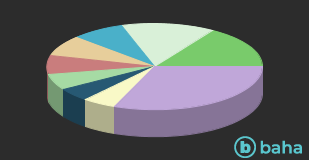

Países

| Spain |

|

16.00% |

| France |

|

14.00% |

| Greece |

|

8.00% |

| Italy |

|

8.00% |

| Netherlands |

|

7.00% |

| Germany |

|

6.00% |

| United States of America |

|

5.00% |

| Ireland |

|

5.00% |

| Otros |

|

31.00% |

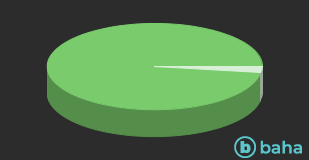

Divisas

| Euro |

|

97.74% |

| Japanese Yen |

|

2.26% |