L&G Absolute Return Bond Plus Fund I EUR Hedged Accumulation

LU0989308175

L&G Absolute Return Bond Plus Fund I EUR Hedged Accumulation/ LU0989308175 /

| NAV10/05/2024 |

Diferencia+0.0009 |

Tipo de beneficio |

Enfoque de la inversión |

Sociedad de fondos |

| 1.1368EUR |

+0.08% |

reinvestment |

Bonds

Worldwide

|

LGIM Managers (EU) ▶ |

Estrategia de inversión

The objective of the Fund is to provide a combination of growth and income above those of the ICE BofA USD 3 Month Deposit Offered Rate Constant Maturity Total Return Index, the "Benchmark Index". The Fund is actively managed and aims to outperform the Benchmark Index by 3.5% per annum. The Fund aims to deliver this objective while decarbonising the portfolio over time, targeting a 50% reduction in weighted average carbon intensity by 2030, compared to a December 2019 baseline level. The Fund aims to generate positive returns in all market conditions. The Fund has a higher performance target than that of the L&G Absolute Return Bond Fund. The objective is before the deduction of any charges and measured over rolling three year periods. There can be no assurance that the Fund will achieve its investment objective.

The Manager has broad discretion over the composition of the Fund"s portfolio. The Fund will invest predominantly in fixed income securities. These include bonds and other debt instruments, issued in a variety of currencies by companies and governments from around the world. In addition to decreasing the weighted average carbon intensity over time, the Fund promotes a range of environmental and social characteristics by: - Excluding investments in bonds issued by companies in the LGIM Future World Protection List ("FWPL"). - Excluding companies from the Fund which do not meet the Manager"s "Climate Impact Pledge", in order to encourage strong governance and sustainable strategies. The Fund will invest primarily in debt rated by a recognised rating agency as investment grade (rated as lower risk). It may also invest in debt rated as sub-investment grade (rated as higher risk). The Fund may also invest in unrated bonds which have not been rated by a credit rating agency. The Fund may also invest in transferable securities, including but not limited to, depository receipts, permitted deposits, money market instruments, cash, near cash and units in collective investment schemes. The absolute return philosophy is focused on capital preservation and minimising falls in value. In order to achieve consistent positive returns, significant emphasis is placed on risk management and avoiding downside scenarios. The Fund will use derivatives extensively for investment purposes or to reduce risk or cost or to generate additional growth. Derivatives are financial instruments whose values are based upon the price of one or more other asset(s). Usage of derivatives is monitored to ensure that the Fund is not exposed to excessive or unintended risks.

Objetivo de inversión

The objective of the Fund is to provide a combination of growth and income above those of the ICE BofA USD 3 Month Deposit Offered Rate Constant Maturity Total Return Index, the "Benchmark Index". The Fund is actively managed and aims to outperform the Benchmark Index by 3.5% per annum. The Fund aims to deliver this objective while decarbonising the portfolio over time, targeting a 50% reduction in weighted average carbon intensity by 2030, compared to a December 2019 baseline level. The Fund aims to generate positive returns in all market conditions. The Fund has a higher performance target than that of the L&G Absolute Return Bond Fund. The objective is before the deduction of any charges and measured over rolling three year periods. There can be no assurance that the Fund will achieve its investment objective.

Datos maestros

| Tipo de beneficio: |

reinvestment |

| Categoría de fondos: |

Bonds |

| Región: |

Worldwide |

| Sucursal: |

Bonds: Mixed |

| Punto de referencia: |

ICE BofA USD LIBOR 3 Month Constant Maturity Index TR |

| Inicio del año fiscal: |

01/01 |

| Última distribución: |

- |

| Banco depositario: |

Northern Trust Global Services SE |

| País de origen: |

Luxembourg |

| Permiso de distribución: |

Germany, Switzerland, Luxembourg |

| Gestor de fondo: |

Colin Reedie, Matthew Rees |

| Volumen de fondo: |

315.71 millones

USD

|

| Fecha de fundación: |

20/02/2020 |

| Enfoque de la inversión: |

- |

Condiciones

| Recargo de emisión: |

5.00% |

| Max. Comisión de administración: |

0.63% |

| Inversión mínima: |

1,000,000.00 EUR |

| Deposit fees: |

0.01% |

| Cargo por amortización: |

0.00% |

| Prospecto simplificado: |

Descargar (Versión para imprimir) |

Sociedad de fondos

| Fondos de empresa: |

LGIM Managers (EU) |

| Dirección: |

2 Dublin Landings, 1-W-131, Dublin |

| País: |

Ireland |

| Internet: |

www.lgim.com/ie/

|

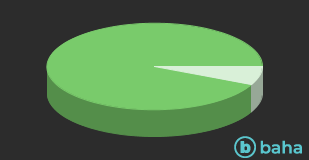

Activos

| Bonds |

|

93.00% |

| Cash and Other Assets |

|

7.00% |

Países

| United States of America |

|

28.17% |

| United Kingdom |

|

15.98% |

| Spain |

|

4.20% |

| Italy |

|

4.10% |

| France |

|

3.30% |

| Germany |

|

2.80% |

| Netherlands |

|

2.00% |

| India |

|

2.00% |

| Chile |

|

1.90% |

| Otros |

|

35.55% |

Divisas

| US Dollar |

|

64.90% |

| British Pound |

|

17.50% |

| Euro |

|

17.00% |

| Australian Dollar |

|

0.30% |

| Otros |

|

0.30% |