JPM Global Macro Opportunities D (acc) - EUR

LU0115098948

JPM Global Macro Opportunities D (acc) - EUR/ LU0115098948 /

| Стоимость чистых активов15.05.2024 |

Изменение-0.1900 |

Тип доходности |

Инвестиционная направленность |

Инвестиционная компания |

| 138.8400EUR |

-0.14% |

reinvestment |

Alternative Investments

Worldwide

|

JPMorgan AM (EU) ▶ |

Инвестиционная стратегия

To achieve capital appreciation in excess of its cash benchmark by investing primarily in securities, globally, using derivatives where appropriate.

Primarily invests, either directly or through derivatives, in equities, commodity index instruments, convertible securities, debt securities and currencies. Issuers of these securities may be located in any country, including emerging markets. The Sub-Fund may also invest in below investment grade and unrated debt securities. The Sub-Fund may invest up to 10% of its assets in onshore PRC securities including China A-Shares through the China-Hong Kong Stock Connect Programmes and onshore debt securities issued within the PRC through China-Hong Kong Bond Connect. Allocations may vary significantly and the Sub-Fund may be concentrated in, or have net long or net short exposure to, certain markets, sectors or currencies from time to time. Up to 100% of assets in Deposits with Credit Institutions and money market instruments and up to 10% of assets in money market funds for investment purposes, defensive purposes and for managing cash subscriptions and redemptions as well as current and exceptional payments.

Инвестиционная цель

To achieve capital appreciation in excess of its cash benchmark by investing primarily in securities, globally, using derivatives where appropriate.

Основные данные

| Тип доходности: |

reinvestment |

| Категории фондов: |

Alternative Investments |

| Регион: |

Worldwide |

| Branch: |

AI Hedgefonds Single Strategy |

| Бенчмарк: |

ICE BofA ESTR Overnight Rate Index Total Return in EUR |

| Начало рабочего (бизнес) года: |

01.01 |

| Last Distribution: |

- |

| Депозитарный банк: |

J.P. Morgan SE - Zweigniederlassung Luxemburg |

| Место жительства фонда: |

Luxembourg |

| Разрешение на распространение: |

Austria, Germany, Switzerland, United Kingdom, Luxembourg |

| Управляющий фондом: |

Shrenick Shah, Josh Berelowitz |

| Объем фонда: |

2.57 млрд

EUR

|

| Дата запуска: |

12.12.2001 |

| Инвестиционная направленность: |

- |

Условия

| Эмиссионная надбавка: |

5.00% |

| Max. Administration Fee: |

1.25% |

| Минимальное вложение: |

5,000.00 EUR |

| Deposit fees: |

- |

| Комиссионные, взимаемые фондами взаимных инвестиций при погашении акций: |

0.50% |

| Упрощенный проспект: |

Скачать (Версия для печати) |

Инвестиционная компания

| Товарищества на вере: |

JPMorgan AM (EU) |

| Адрес: |

PO Box 275, 2012, Luxembourg |

| Страна: |

Luxembourg |

| Интернет: |

www.jpmorganassetmanagement.de

|

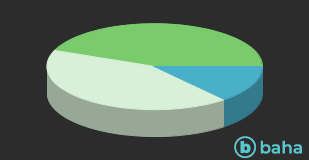

Активы

| Bonds |

|

44.00% |

| Stocks |

|

42.20% |

| Cash and Other Assets |

|

13.80% |

Страны

| Global |

|

86.20% |

| Другие |

|

13.80% |