JPM-Global Healthcare Fd.A(acc)EUR

LU0880062913

JPM-Global Healthcare Fd.A(acc)EUR/ LU0880062913 /

| NAV26/04/2024 |

Var.-0.3200 |

Type of yield |

Focus sugli investimenti |

Società d'investimento |

| 283.1600EUR |

-0.11% |

reinvestment |

Equity

Worldwide

|

JPMorgan AM (EU) ▶ |

Investment strategy

To achieve a return by investing primarily in pharmaceutical, biotechnology, healthcare services, medical technology and life sciences companies ("Healthcare Companies"), globally.

At least 67% of assets invested in Healthcare Companies anywhere in the world. The Sub-Fund may invest in smaller capitalisation companies. At least 51% of assets are invested in companies with positive environmental and/or social characteristics that follow good governance practices as measured through the Investment Manager's proprietary ESG scoring methodology and/or third party data.

Investment goal

To achieve a return by investing primarily in pharmaceutical, biotechnology, healthcare services, medical technology and life sciences companies ("Healthcare Companies"), globally.

Dati master

| Type of yield: |

reinvestment |

| Fondi Categoria: |

Equity |

| Region: |

Worldwide |

| Settore: |

Sector Health / Pharma |

| Benchmark: |

MSCI World Healthcare Index (Total Return Net) |

| Business year start: |

01/07 |

| Ultima distribuzione: |

- |

| Banca depositaria: |

J.P. Morgan Bank Luxembourg S.A. |

| Domicilio del fondo: |

Luxembourg |

| Permesso di distribuzione: |

Austria, Germany, Switzerland, United Kingdom |

| Gestore del fondo: |

Matthew Cohen, Holly Fleiss, Dom Valder |

| Volume del fondo: |

4.14 bill.

USD

|

| Data di lancio: |

01/02/2013 |

| Investment focus: |

- |

Condizioni

| Sovrapprezzo emissione: |

5.00% |

| Tassa amministrativa massima: |

1.50% |

| Investimento minimo: |

35,000.00 EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.50% |

| Prospetto semplificato: |

Download (Print version) |

Società d'investimento

| Funds company: |

JPMorgan AM (EU) |

| Indirizzo: |

PO Box 275, 2012, Luxembourg |

| Paese: |

Luxembourg |

| Internet: |

www.jpmorganassetmanagement.de

|

Attività

| Stocks |

|

98.72% |

| Mutual Funds |

|

1.28% |

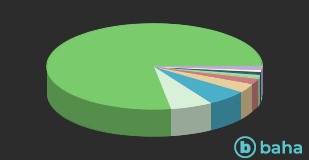

Paesi

| United States of America |

|

77.49% |

| Denmark |

|

6.39% |

| United Kingdom |

|

6.08% |

| Switzerland |

|

3.39% |

| France |

|

2.31% |

| Japan |

|

1.52% |

| Netherlands |

|

0.89% |

| Germany |

|

0.67% |

| Altri |

|

1.26% |

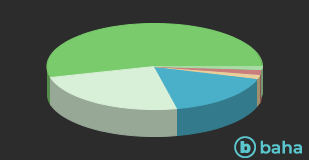

Filiali

| Pharma/Biotechnology |

|

54.15% |

| Healthcare services |

|

24.31% |

| Healthcare appliances |

|

16.91% |

| Parma, wholesale |

|

1.71% |

| Gesundheitswesen/ Informationstechnologie |

|

1.64% |

| Altri |

|

1.28% |