Dynasty Euro Yield A USD

LU2440451206

Dynasty Euro Yield A USD/ LU2440451206 /

| NAV13/05/2024 |

Diferencia+0.0800 |

Tipo de beneficio |

Enfoque de la inversión |

Sociedad de fondos |

| 110.9000USD |

+0.07% |

reinvestment |

Bonds

Worldwide

|

Dynasty AM ▶ |

Estrategia de inversión

The objective of the Class A EUR shares of "Dynasty Euro Yield" (the "Sub-Fund") is to provide positive returns over the medium term, through the selection of a portfolio of fixed income asset classes, markets and fixed income financial instruments offering an attractive yield considering the issuer"s credit risk. The Sub-Fund is actively managed and is not managed in reference to a benchmark. The Sub-Fund does not offer any form of guarantee with respect to investment performance and no form of capital protection applies. The investment policy of the Sub-Fund consists in holding a portfolio of corporate fixed-income securities. Such securities will have, at the time of their acquisition, an attractive yield, taking into account the creditworthiness of their issuer. The Sub-Fund"s average interest rate sensitivity (duration) will range between 0 to 8 years.

The Sub-Fund will invest up to one hundred percent (100%) of its net assets in fixed-income securities such as standard bonds but also convertible bonds or similar fixed income instruments and Money Market Instruments including Negotiable Debt Instruments (NDI). The Sub-Fund may invest up to 20% of its net assets in perpetual bonds, futures, listed options and OTC derivatives. The fixed-income securities are only denominated in euros and issued by International (both European and Non-European) issuers. Securities may have no minimum rating at the time of their acquisition. Investments in High Yield or non-rated securities will therefore be possible up to 100% of the net assets of the Sub-Fund. Investments in instruments qualifying as distressed securities at the time of purchase are limited to 10% of the Sub-Fund's net assets. The Sub-Fund may invest up to 10% of its net assets in contingent convertible bonds ("Cocos"). The average equity sensitivity (delta) of the Sub-Fund from its exposure to Convertible bonds will be below 10%. Derivatives instruments may only be used in the context of hedging the Sub-Fund's assets against the interest and credit risk. The commitment resulting from such transactions and contracts may not exceed the SubFund's assets.

Objetivo de inversión

The objective of the Class A EUR shares of "Dynasty Euro Yield" (the "Sub-Fund") is to provide positive returns over the medium term, through the selection of a portfolio of fixed income asset classes, markets and fixed income financial instruments offering an attractive yield considering the issuer"s credit risk. The Sub-Fund is actively managed and is not managed in reference to a benchmark. The Sub-Fund does not offer any form of guarantee with respect to investment performance and no form of capital protection applies. The investment policy of the Sub-Fund consists in holding a portfolio of corporate fixed-income securities. Such securities will have, at the time of their acquisition, an attractive yield, taking into account the creditworthiness of their issuer. The Sub-Fund"s average interest rate sensitivity (duration) will range between 0 to 8 years.

Datos maestros

| Tipo de beneficio: |

reinvestment |

| Categoría de fondos: |

Bonds |

| Región: |

Worldwide |

| Sucursal: |

Bonds: Mixed |

| Punto de referencia: |

50% iBoxx euro corporate, 50% Markit iBoxx EUR High Yield Main |

| Inicio del año fiscal: |

01/01 |

| Última distribución: |

- |

| Banco depositario: |

UBS Europe SE, Luxembourg Branch |

| País de origen: |

Luxembourg |

| Permiso de distribución: |

Switzerland |

| Gestor de fondo: |

- |

| Volumen de fondo: |

9.93 millones

EUR

|

| Fecha de fundación: |

27/04/2022 |

| Enfoque de la inversión: |

- |

Condiciones

| Recargo de emisión: |

1.00% |

| Max. Comisión de administración: |

0.80% |

| Inversión mínima: |

100.00 USD |

| Deposit fees: |

- |

| Cargo por amortización: |

0.00% |

| Prospecto simplificado: |

- |

Sociedad de fondos

| Fondos de empresa: |

Dynasty AM |

| Dirección: |

16, avenue Marie-Therèse, 2132, Luxemburg |

| País: |

Luxembourg |

| Internet: |

www.dynasty-am.lu

|

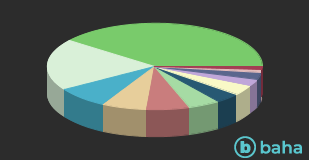

Países

| France |

|

39.60% |

| Germany |

|

19.50% |

| Switzerland |

|

8.00% |

| Sweden |

|

6.70% |

| United States of America |

|

6.50% |

| United Kingdom |

|

4.80% |

| Italy |

|

3.80% |

| Luxembourg |

|

3.70% |

| Romania |

|

2.70% |

| Belgium |

|

2.60% |

| Cash |

|

1.00% |

| Otros |

|

1.10% |