DWS SDG Multi Asset Dynamic LC

DE0009848010

DWS SDG Multi Asset Dynamic LC/ DE0009848010 /

| NAV15.05.2024 |

Zm.+0,1500 |

Typ dystrybucji dochodów |

Kategoria |

Firma inwestycyjna |

| 86,9100EUR |

+0,17% |

z reinwestycją |

Fundusz mieszany

Światowy

|

DWS Investment GmbH ▶ |

Strategia inwestycyjna

The fund is actively managed. The fund is not managed in reference to a benchmark. The fund promotes environmental and social characteristics and is subject to the disclosure requirements of a financial product in accordance with article 8(1) of Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. More ESG information is available in the sales prospectus and on the DWS website. The objective of the investment policy is to achieve the highest possible appreciation of capital.

To achieve this, the fund invests in interest-bearing securities, equities, certificates, funds and banks balances. At least 60% of the investment fund"s assets must be invested in equities, equity funds and/or equity certificates. Up to 40% of the investment fund"s assets may be invested in interestbearing securities such as government bonds, corporate bonds or convertible bonds of domestic and foreign issuers, in certificates on bonds or bond indices or in bond funds. Of this portion, at least 51% of the corresponding investment ratio must be invested in securities that are denominated in euro or hedged against the euro and have investment grade status at the time the securities are purchased. Up to 10% of the investment fund"s assets may be invested in certificates on commodities and commodity indices. Up to 40% of the fund"s assets may be invested in money market instruments, money market funds and money market funds with short maturity structures. When selecting the suitable investments, environmental and social aspects as well as the principles of corporate governance ("ESG standards") are of key importance for the implementation of the fund"s sustainable investment strategy.

Cel inwestycyjny

The fund is actively managed. The fund is not managed in reference to a benchmark. The fund promotes environmental and social characteristics and is subject to the disclosure requirements of a financial product in accordance with article 8(1) of Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. More ESG information is available in the sales prospectus and on the DWS website. The objective of the investment policy is to achieve the highest possible appreciation of capital.

Dane podstawowe

| Typ dystrybucji dochodów: |

z reinwestycją |

| Kategoria funduszy: |

Fundusz mieszany |

| Region: |

Światowy |

| Branża: |

Fundusze mieszane z przewagą akcji |

| Benchmark: |

- |

| Początek roku obrachunkowego: |

01.10 |

| Last Distribution: |

02.01.2018 |

| Bank depozytariusz: |

State Street Bank International GmbH |

| Kraj pochodzenia funduszu: |

Niemcy |

| Zezwolenie na dystrybucję: |

Austria, Niemcy |

| Zarządzający funduszem: |

Gerrit Rohleder |

| Aktywa: |

886,26 mln

EUR

|

| Data startu: |

12.01.2000 |

| Koncentracja inwestycyjna: |

- |

Warunki

| Opłata za nabycie: |

5,00% |

| Max. Administration Fee: |

1,40% |

| Minimalna inwestycja: |

- EUR |

| Opłaty depozytowe: |

- |

| Opłata za odkupienie: |

0,00% |

| Uproszczony prospekt: |

Ściągnij (Wersja do wydruku) |

Firma inwestycyjna

| TFI: |

DWS Investment GmbH |

| Adres: |

Mainzer Landstraße 11-17, 60329, Frankfurt am Main |

| Kraj: |

Niemcy |

| Internet: |

www.dws.de

|

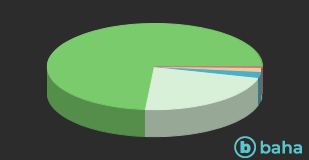

Aktywa

| Akcje |

|

73,70% |

| Obligacje |

|

22,20% |

| Fundusze inwestycyjne |

|

2,20% |

| Gotówka |

|

1,60% |

| Inne |

|

0,30% |

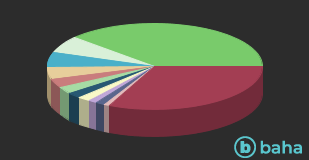

Kraje

| USA |

|

38,30% |

| Japonia |

|

6,30% |

| Francja |

|

5,70% |

| Niemcy |

|

4,50% |

| Wielka Brytania |

|

3,30% |

| Hiszpania |

|

2,50% |

| Kanada |

|

2,20% |

| Holandia |

|

1,90% |

| Australia |

|

1,30% |

| Republika Korei |

|

1,30% |

| Norwegia |

|

0,90% |

| Inne |

|

31,80% |

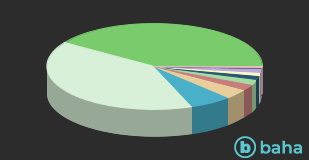

Waluty

| Dolar amerykański |

|

40,70% |

| Euro |

|

40,00% |

| Jen japoński |

|

6,40% |

| Funt brytyjski |

|

3,70% |

| Dolar kanadyjski |

|

2,30% |

| Korona norweska |

|

2,00% |

| Dolar hongkoński |

|

1,40% |

| Dolar australijski |

|

1,30% |

| Won koreański |

|

1,30% |

| Frank szwajcarski |

|

0,50% |

| Korona duńska |

|

0,40% |