DWS SDG Multi Asset Dynamic LC

DE0009848010

DWS SDG Multi Asset Dynamic LC/ DE0009848010 /

| NAV15/05/2024 |

Var.+0.1500 |

Type of yield |

Focus sugli investimenti |

Società d'investimento |

| 86.9100EUR |

+0.17% |

reinvestment |

Mixed Fund

Worldwide

|

DWS Investment GmbH ▶ |

Investment strategy

The fund is actively managed. The fund is not managed in reference to a benchmark. The fund promotes environmental and social characteristics and is subject to the disclosure requirements of a financial product in accordance with article 8(1) of Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. More ESG information is available in the sales prospectus and on the DWS website. The objective of the investment policy is to achieve the highest possible appreciation of capital.

To achieve this, the fund invests in interest-bearing securities, equities, certificates, funds and banks balances. At least 60% of the investment fund"s assets must be invested in equities, equity funds and/or equity certificates. Up to 40% of the investment fund"s assets may be invested in interestbearing securities such as government bonds, corporate bonds or convertible bonds of domestic and foreign issuers, in certificates on bonds or bond indices or in bond funds. Of this portion, at least 51% of the corresponding investment ratio must be invested in securities that are denominated in euro or hedged against the euro and have investment grade status at the time the securities are purchased. Up to 10% of the investment fund"s assets may be invested in certificates on commodities and commodity indices. Up to 40% of the fund"s assets may be invested in money market instruments, money market funds and money market funds with short maturity structures. When selecting the suitable investments, environmental and social aspects as well as the principles of corporate governance ("ESG standards") are of key importance for the implementation of the fund"s sustainable investment strategy.

Investment goal

The fund is actively managed. The fund is not managed in reference to a benchmark. The fund promotes environmental and social characteristics and is subject to the disclosure requirements of a financial product in accordance with article 8(1) of Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. More ESG information is available in the sales prospectus and on the DWS website. The objective of the investment policy is to achieve the highest possible appreciation of capital.

Dati master

| Type of yield: |

reinvestment |

| Fondi Categoria: |

Mixed Fund |

| Region: |

Worldwide |

| Settore: |

Mixed Fund/Focus Equity |

| Benchmark: |

- |

| Business year start: |

01/10 |

| Ultima distribuzione: |

02/01/2018 |

| Banca depositaria: |

State Street Bank International GmbH |

| Domicilio del fondo: |

Germany |

| Permesso di distribuzione: |

Austria, Germany |

| Gestore del fondo: |

Gerrit Rohleder |

| Volume del fondo: |

886.26 mill.

EUR

|

| Data di lancio: |

12/01/2000 |

| Investment focus: |

- |

Condizioni

| Sovrapprezzo emissione: |

5.00% |

| Tassa amministrativa massima: |

1.40% |

| Investimento minimo: |

- EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Prospetto semplificato: |

Download (Print version) |

Società d'investimento

| Funds company: |

DWS Investment GmbH |

| Indirizzo: |

Mainzer Landstraße 11-17, 60329, Frankfurt am Main |

| Paese: |

Germany |

| Internet: |

www.dws.de

|

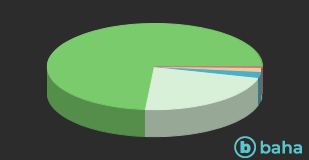

Attività

| Stocks |

|

73.70% |

| Bonds |

|

22.20% |

| Mutual Funds |

|

2.20% |

| Cash |

|

1.60% |

| Altri |

|

0.30% |

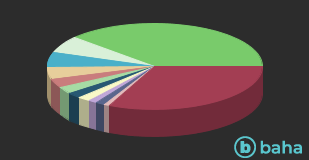

Paesi

| United States of America |

|

38.30% |

| Japan |

|

6.30% |

| France |

|

5.70% |

| Germany |

|

4.50% |

| United Kingdom |

|

3.30% |

| Spain |

|

2.50% |

| Canada |

|

2.20% |

| Netherlands |

|

1.90% |

| Australia |

|

1.30% |

| Korea, Republic Of |

|

1.30% |

| Norway |

|

0.90% |

| Altri |

|

31.80% |

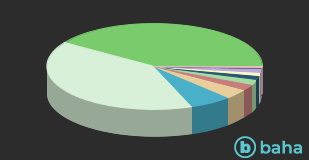

Cambi

| US Dollar |

|

40.70% |

| Euro |

|

40.00% |

| Japanese Yen |

|

6.40% |

| British Pound |

|

3.70% |

| Canadian Dollar |

|

2.30% |

| Norwegian Kroner |

|

2.00% |

| Hong Kong Dollar |

|

1.40% |

| Australian Dollar |

|

1.30% |

| Korean Won |

|

1.30% |

| Swiss Franc |

|

0.50% |

| Danish Krone |

|

0.40% |