DWS Global Hybrid Bond Fund LD

DE0008490988

DWS Global Hybrid Bond Fund LD/ DE0008490988 /

| Стоимость чистых активов21.05.2024 |

Изменение+0.0300 |

Тип доходности |

Инвестиционная направленность |

Инвестиционная компания |

| 36.9700EUR |

+0.08% |

paying dividend |

Bonds

Worldwide

|

DWS Investment GmbH ▶ |

Инвестиционная стратегия

The fund is actively managed. The fund is not managed in reference to a benchmark. The fund promotes environmental and social characteristics and is subject to the disclosure requirements of a financial product in accordance with article 8(1) of Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. More ESG information is available in the sales prospectus and on the DWS website. The objective of the investment policy is to generate capital appreciation.

To achieve this, the fund invests predominantly in hybrid bonds. Hybrid bonds are equity-like, subordinated corporate bonds with very long maturities or without a maturity date, they can be terminated by the issuer as of a previously defined date. In terms of their characteristics, they lie between equities and fixed rate securities. The selection of the individual investments is at the discretion of the fund management. The fund promotes environmental and social characteristics or a combination of these characteristics without pursuing an explicit ESG and/or sustainable investment strategy. The return of the product is reflected by the daily calculated net asset value per unit and the distribution amount if applicable.To achieve this, the fund invests predominantly in hybrid bonds. Hybrid bonds are equity-like, subordinated corporate bonds with very long maturities or without a maturity date, they can be terminated by the issuer as of a previously defined date. In terms of their characteristics, they lie between equities and fixed rate securities. The selection of the individual investments is at the discretion of the fund management. The fund promotes environmental and social characteristics or a combination of these characteristics without pursuing an explicit ESG and/or sustainable investment strategy.

Инвестиционная цель

The fund is actively managed. The fund is not managed in reference to a benchmark. The fund promotes environmental and social characteristics and is subject to the disclosure requirements of a financial product in accordance with article 8(1) of Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. More ESG information is available in the sales prospectus and on the DWS website. The objective of the investment policy is to generate capital appreciation.

Основные данные

| Тип доходности: |

paying dividend |

| Категории фондов: |

Bonds |

| Регион: |

Worldwide |

| Branch: |

Corporate Bonds |

| Бенчмарк: |

- |

| Начало рабочего (бизнес) года: |

01.10 |

| Last Distribution: |

24.11.2023 |

| Депозитарный банк: |

State Street Bank International GmbH |

| Место жительства фонда: |

Germany |

| Разрешение на распространение: |

Austria, Germany, Switzerland |

| Управляющий фондом: |

Liller, Michael |

| Объем фонда: |

207.78 млн

EUR

|

| Дата запуска: |

21.06.1993 |

| Инвестиционная направленность: |

- |

Условия

| Эмиссионная надбавка: |

3.00% |

| Max. Administration Fee: |

0.75% |

| Минимальное вложение: |

0.00 EUR |

| Deposit fees: |

- |

| Комиссионные, взимаемые фондами взаимных инвестиций при погашении акций: |

0.00% |

| Упрощенный проспект: |

Скачать (Версия для печати) |

Инвестиционная компания

| Товарищества на вере: |

DWS Investment GmbH |

| Адрес: |

Mainzer Landstraße 11-17, 60329, Frankfurt am Main |

| Страна: |

Germany |

| Интернет: |

www.dws.de

|

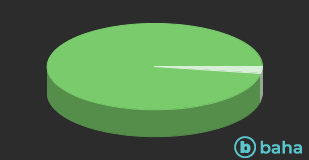

Активы

| Bonds |

|

97.56% |

| Money Market |

|

2.44% |

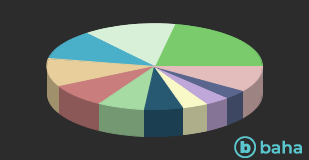

Страны

| Spain |

|

21.97% |

| France |

|

13.87% |

| Italy |

|

11.33% |

| United Kingdom |

|

10.55% |

| Germany |

|

8.79% |

| Ireland |

|

7.03% |

| Netherlands |

|

5.86% |

| Denmark |

|

3.81% |

| Sweden |

|

3.71% |

| Portugal |

|

3.52% |

| Другие |

|

9.56% |