DWS Global Hybrid Bond Fund LD

DE0008490988

DWS Global Hybrid Bond Fund LD/ DE0008490988 /

| NAV21.05.2024 |

Zm.+0,0300 |

Typ dystrybucji dochodów |

Kategoria |

Firma inwestycyjna |

| 36,9700EUR |

+0,08% |

płacące dywidendę |

Obligacje

Światowy

|

DWS Investment GmbH ▶ |

Strategia inwestycyjna

The fund is actively managed. The fund is not managed in reference to a benchmark. The fund promotes environmental and social characteristics and is subject to the disclosure requirements of a financial product in accordance with article 8(1) of Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. More ESG information is available in the sales prospectus and on the DWS website. The objective of the investment policy is to generate capital appreciation.

To achieve this, the fund invests predominantly in hybrid bonds. Hybrid bonds are equity-like, subordinated corporate bonds with very long maturities or without a maturity date, they can be terminated by the issuer as of a previously defined date. In terms of their characteristics, they lie between equities and fixed rate securities. The selection of the individual investments is at the discretion of the fund management. The fund promotes environmental and social characteristics or a combination of these characteristics without pursuing an explicit ESG and/or sustainable investment strategy. The return of the product is reflected by the daily calculated net asset value per unit and the distribution amount if applicable.To achieve this, the fund invests predominantly in hybrid bonds. Hybrid bonds are equity-like, subordinated corporate bonds with very long maturities or without a maturity date, they can be terminated by the issuer as of a previously defined date. In terms of their characteristics, they lie between equities and fixed rate securities. The selection of the individual investments is at the discretion of the fund management. The fund promotes environmental and social characteristics or a combination of these characteristics without pursuing an explicit ESG and/or sustainable investment strategy.

Cel inwestycyjny

The fund is actively managed. The fund is not managed in reference to a benchmark. The fund promotes environmental and social characteristics and is subject to the disclosure requirements of a financial product in accordance with article 8(1) of Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. More ESG information is available in the sales prospectus and on the DWS website. The objective of the investment policy is to generate capital appreciation.

Dane podstawowe

| Typ dystrybucji dochodów: |

płacące dywidendę |

| Kategoria funduszy: |

Obligacje |

| Region: |

Światowy |

| Branża: |

Obligacje korporacyjne |

| Benchmark: |

- |

| Początek roku obrachunkowego: |

01.10 |

| Last Distribution: |

24.11.2023 |

| Bank depozytariusz: |

State Street Bank International GmbH |

| Kraj pochodzenia funduszu: |

Niemcy |

| Zezwolenie na dystrybucję: |

Austria, Niemcy, Szwajcaria |

| Zarządzający funduszem: |

Liller, Michael |

| Aktywa: |

207,78 mln

EUR

|

| Data startu: |

21.06.1993 |

| Koncentracja inwestycyjna: |

- |

Warunki

| Opłata za nabycie: |

3,00% |

| Max. Administration Fee: |

0,75% |

| Minimalna inwestycja: |

0,00 EUR |

| Opłaty depozytowe: |

- |

| Opłata za odkupienie: |

0,00% |

| Uproszczony prospekt: |

Ściągnij (Wersja do wydruku) |

Firma inwestycyjna

| TFI: |

DWS Investment GmbH |

| Adres: |

Mainzer Landstraße 11-17, 60329, Frankfurt am Main |

| Kraj: |

Niemcy |

| Internet: |

www.dws.de

|

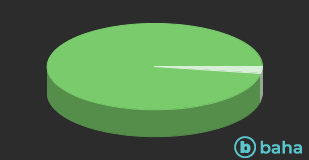

Aktywa

| Obligacje |

|

97,56% |

| Rynek pieniężny |

|

2,44% |

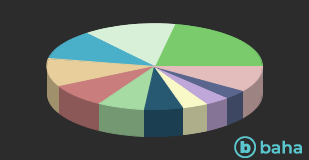

Kraje

| Hiszpania |

|

21,97% |

| Francja |

|

13,87% |

| Włochy |

|

11,33% |

| Wielka Brytania |

|

10,55% |

| Niemcy |

|

8,79% |

| Irlandia |

|

7,03% |

| Holandia |

|

5,86% |

| Dania |

|

3,81% |

| Szwecja |

|

3,71% |

| Portugalia |

|

3,52% |

| Inne |

|

9,56% |