Cullen North American Hi.Div.Val.Eq.A2

IE00B4X0HW56

Cullen North American Hi.Div.Val.Eq.A2/ IE00B4X0HW56 /

| NAV15/05/2024 |

Chg.+0.1400 |

Type de rendement |

Focus sur l'investissement |

Société de fonds |

| 18.9900EUR |

+0.74% |

reinvestment |

Equity

Mixed Sectors

|

Cullen Capital M. ▶ |

Stratégie d'investissement

This product aims for long term growth in, as well as returning income on, the value of your investment. Primarily, the product will purchase dividend paying shares of companies diversified across 15-25 industries and which are both incorporated in the U.S. and listed on stock exchanges there (the "Companies" and each a "Company").

In selecting which of such Companies" shares to purchase, the product will generally use the following criteria: (i) the total value of the Company"s listed shares exceeds US$3 billion; (ii) relative to share price, dividend yield on the Company"s shares is greater than the average dividend yield on shares comprising the S&P 500 Index (which is an index of 500 shares intended to be a representative sample of leading companies in leading industries within the U.S. economy); (iii) the Company"s price/earnings ratio is below the average price/earnings ratio on shares comprising the S&P 500 Index (a price/earnings ratio is a valuation ratio of a company"s current share price compared to its per-share earnings and essentially shows how much one needs to pay per dollar of earnings - if a company were trading at a price/earnings ratio of 20, the interpretation is that an investor is willing to pay $20 for $1 of current earnings); and (iv) based on the Company"s historical dividend growth and overall well-being, there is strong potential for higher dividends (i.e. an increase in the actual dollar amount of the dividend irrespective of the dividend yield).

Objectif d'investissement

This product aims for long term growth in, as well as returning income on, the value of your investment. Primarily, the product will purchase dividend paying shares of companies diversified across 15-25 industries and which are both incorporated in the U.S. and listed on stock exchanges there (the "Companies" and each a "Company").

Opérations

| Type de rendement: |

reinvestment |

| Fonds Catégorie: |

Equity |

| Pays: |

United States of America |

| Branche: |

Mixed Sectors |

| Benchmark: |

Russell 1000 Value |

| Début de l'exercice: |

01/07 |

| Dernière distribution: |

- |

| Banque dépositaire: |

Brown Brothers Harriman Trustee Services |

| Domicile: |

Ireland |

| Permission de distribution: |

Austria, Germany |

| Gestionnaire du fonds: |

Jim Cullen & Jennifer Chang |

| Actif net: |

441.8 Mio.

USD

|

| Date de lancement: |

20/03/2012 |

| Focus de l'investissement: |

- |

Conditions

| Surtaxe d'émission: |

5.00% |

| Frais d'administration max.: |

1.50% |

| Investissement minimum: |

1,000.00 EUR |

| Deposit fees: |

- |

| Frais de rachat: |

0.00% |

| Prospectus simplifié: |

Télécharger (Version imprimée) |

Société de fonds

| Société de fonds: |

Cullen Capital M. |

| Adresse: |

70 Sir John Rogerson's Quay, Dublin 2, Dublin |

| Pays: |

Ireland |

| Internet: |

www.cullenfunds.co.uk

|

Pays

| United States of America |

|

100.00% |

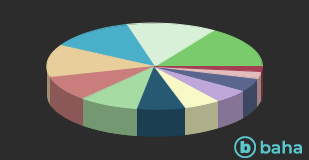

Branches

| Finance |

|

15.80% |

| Healthcare |

|

13.40% |

| Industry |

|

12.70% |

| Basic Consumer Goods |

|

12.30% |

| IT |

|

9.40% |

| Energy |

|

8.90% |

| Telecommunication Services |

|

7.20% |

| real estate |

|

5.50% |

| Utilities |

|

5.30% |

| Consumer goods, cyclical |

|

5.10% |

| Commodities |

|

2.70% |

| Cash |

|

1.70% |