Candriam Equities L Biotech.I-H EUR Acc

LU1006082199

Candriam Equities L Biotech.I-H EUR Acc/ LU1006082199 /

| NAV22/05/2024 |

Var.+15.8501 |

Type of yield |

Focus sugli investimenti |

Società d'investimento |

| 2,068.6001EUR |

+0.77% |

reinvestment |

Equity

Worldwide

|

Candriam ▶ |

Investment strategy

The fund seeks to achieve capital growth by investing in the principal assets traded and to outperform the benchmark.

Equities of companies active in biotechnology whose registered offices and/or principal activities are throughout the world. The management team makes discretionary investment choices based on economic/financial analyses. There are two strands in the selection of companies: a clinical analysis and a fundamental analysis. The clinical analysis aims to assess the quality of the available clinical data and to use only companies found to be convincing in this respect. The fundamental analysis selects the best companies according to five criteria: quality of management, growth potential, competitive advantage, value creation and indebtedness. The fund promotes, among other characteristics, environmental and/or social characteristics but does not have sustainable investment as its objective. The analysis of ESG aspects (environment, social, governance) is included in the selection, analysis and global evaluation of companies. The fund is managed actively and the investment approach implies a reference to a benchmark (the index). The index measures the performance of NASDAQ-listed companies from the biotechnology and pharmaceuticals sector

Investment goal

The fund seeks to achieve capital growth by investing in the principal assets traded and to outperform the benchmark.

Dati master

| Type of yield: |

reinvestment |

| Fondi Categoria: |

Equity |

| Region: |

Worldwide |

| Settore: |

Sector Biotechnology |

| Benchmark: |

Nasdaq Biotechnology Index (Net Return) |

| Business year start: |

01/01 |

| Ultima distribuzione: |

- |

| Banca depositaria: |

CACEIS Bank, Luxembourg Branch |

| Domicilio del fondo: |

Luxembourg |

| Permesso di distribuzione: |

Austria, Germany, Switzerland |

| Gestore del fondo: |

Rudi Van Den Eynde |

| Volume del fondo: |

1.51 bill.

USD

|

| Data di lancio: |

03/12/2015 |

| Investment focus: |

- |

Condizioni

| Sovrapprezzo emissione: |

0.00% |

| Tassa amministrativa massima: |

0.60% |

| Investimento minimo: |

0.00 EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Prospetto semplificato: |

Download (Print version) |

Società d'investimento

| Funds company: |

Candriam |

| Indirizzo: |

19-21 route d'Arlon, 8009, Strassen |

| Paese: |

Luxembourg |

| Internet: |

www.candriam.com

|

Attività

| Stocks |

|

97.74% |

| Cash |

|

2.23% |

| Altri |

|

0.03% |

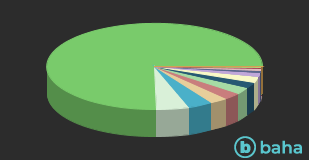

Paesi

| United States of America |

|

75.36% |

| United Kingdom |

|

4.86% |

| Denmark |

|

3.71% |

| Ireland |

|

2.72% |

| Netherlands |

|

2.53% |

| France |

|

2.52% |

| Cash |

|

2.23% |

| Cayman Islands |

|

2.18% |

| Canada |

|

1.49% |

| Germany |

|

0.91% |

| Belgium |

|

0.79% |

| Virgin Islands (British) |

|

0.34% |

| China |

|

0.21% |

| Singapore |

|

0.11% |

| Altri |

|

0.04% |

Filiali

| Pharma/Biotechnology |

|

96.28% |

| Cash |

|

2.23% |

| Healthcare services |

|

1.16% |

| Gesundheitswesen/ Informationstechnologie |

|

0.30% |

| Altri |

|

0.03% |