BGF Global Allocation Fund Hedged A4 EUR

LU0240613025

BGF Global Allocation Fund Hedged A4 EUR/ LU0240613025 /

| NAV02/05/2024 |

Chg.-0.2100 |

Type de rendement |

Focus sur l'investissement |

Société de fonds |

| 38.7700EUR |

-0.54% |

paying dividend |

Mixed Fund

Worldwide

|

BlackRock (LU) ▶ |

Stratégie d'investissement

The Fund aims to maximise the return on your investment through a combination of capital growth and income on the Fund"s assets. The Fund invests globally at least 70% of its total assets in equity securities (e.g. shares) and fixed income (FI) securities in normal market conditions. FI securities include bonds and money market instruments (i.e. debt securities with short term maturities). It may also hold deposits and cash. Subject to the above, the asset classes and the extent to which the Fund is invested in these may vary without limit depending on market conditions.

The FI securities may be issued by governments, government agencies, companies and supranationals (e.g. the International Bank for Reconstruction and Development) and may include securities with a relatively low credit rating or which are unrated. The Fund may also invest in companies that are small in size and are at a relatively early stage in their development. The Fund will generally aim to invest in securities of undervalued companies (i.e. their market price does not reflect their underlying worth). The IA may use financial derivative instruments (FDIs) (i.e. investments the prices of which are based on one or more underlying assets) for investment purposes in order to achieve the investment objective of the Fund, and/or to reduce risk within the Fund"s portfolio, reduce investment costs and generate additional income. The Fund may, via FDIs, generate varying amounts of market leverage (i.e. where the Fund gains market exposure in excess of the value of its assets).

Objectif d'investissement

The Fund aims to maximise the return on your investment through a combination of capital growth and income on the Fund"s assets. The Fund invests globally at least 70% of its total assets in equity securities (e.g. shares) and fixed income (FI) securities in normal market conditions. FI securities include bonds and money market instruments (i.e. debt securities with short term maturities). It may also hold deposits and cash. Subject to the above, the asset classes and the extent to which the Fund is invested in these may vary without limit depending on market conditions.

Opérations

| Type de rendement: |

paying dividend |

| Fonds Catégorie: |

Mixed Fund |

| Région de placement: |

Worldwide |

| Branche: |

Mixed fund/flexible |

| Benchmark: |

S&P 500 (36 %), dem FTSE W. (ex-US) (24 %), 5 Yr US Trea. N. (24 %), FTSE Non-USD WGBI (16 %) |

| Début de l'exercice: |

01/09 |

| Dernière distribution: |

31/08/2023 |

| Banque dépositaire: |

The Bank of New York Mellon SA/NV, Zweigniederlassung Luxemburg |

| Domicile: |

Luxembourg |

| Permission de distribution: |

Austria, Germany, Switzerland, United Kingdom |

| Gestionnaire du fonds: |

Russ Koesterich, David Clayton, Rick Rieder |

| Actif net: |

14.56 Mrd.

USD

|

| Date de lancement: |

24/01/2007 |

| Focus de l'investissement: |

- |

Conditions

| Surtaxe d'émission: |

5.00% |

| Frais d'administration max.: |

1.50% |

| Investissement minimum: |

5,000.00 EUR |

| Deposit fees: |

0.45% |

| Frais de rachat: |

0.00% |

| Prospectus simplifié: |

Télécharger (Version imprimée) |

Société de fonds

| Société de fonds: |

BlackRock (LU) |

| Adresse: |

35a Avenue JF Kennedy, 1855, Luxemburg |

| Pays: |

Luxembourg |

| Internet: |

www.blackrock.com

|

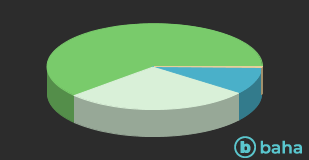

Actifs

| Stocks |

|

61.69% |

| Bonds |

|

27.93% |

| Cash |

|

10.09% |

| Autres |

|

0.29% |

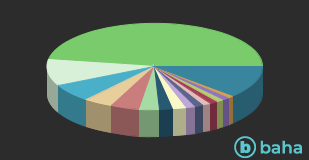

Pays

| United States of America |

|

47.33% |

| Cash |

|

10.09% |

| United Kingdom |

|

6.71% |

| Germany |

|

4.32% |

| Japan |

|

4.31% |

| France |

|

2.99% |

| Switzerland |

|

2.06% |

| Netherlands |

|

1.96% |

| Canada |

|

1.44% |

| Mexico |

|

1.30% |

| Brazil |

|

1.29% |

| Australia |

|

1.20% |

| Italy |

|

1.18% |

| China |

|

1.02% |

| Spain |

|

0.85% |

| Autres |

|

11.95% |