Bellevue Funds (Lux) -Bellevue Obesity Solutions B EUR - Accumulating

LU0415392249

Bellevue Funds (Lux) -Bellevue Obesity Solutions B EUR - Accumulating/ LU0415392249 /

| NAV06/05/2024 |

Chg.+1.2500 |

Type de rendement |

Focus sur l'investissement |

Société de fonds |

| 628.6800EUR |

+0.20% |

reinvestment |

Equity

Worldwide

|

Waystone M.Co.(Lux) ▶ |

Stratégie d'investissement

The Fund invests at least two thirds of the net assets of Bellevue Biotech in a portfolio of carefully chosen shares and other equity securities of companies in the biotechnology industry or companies whose main activity involves holding investments in such companies or financing such companies and that have their registered office or carry out the majority of their economic activity in recognised countries.

Without restricting the scope of the term "biotechnology", the companies within the entire value chain in the biotechnology sector consist especially of companies that prepare, develop, utilise, market and/or sell processes, methods, technologies and products in which organisms, cells or cell constituents are used. Up to one third of the net assets can be invested in debt securities of private and government issuers with various terms and credit ratings. The Fund may engage in derivative transactions in order to achieve an efficient portfolio management, in particular also for hedging purposes.

Objectif d'investissement

The Fund invests at least two thirds of the net assets of Bellevue Biotech in a portfolio of carefully chosen shares and other equity securities of companies in the biotechnology industry or companies whose main activity involves holding investments in such companies or financing such companies and that have their registered office or carry out the majority of their economic activity in recognised countries.

Opérations

| Type de rendement: |

reinvestment |

| Fonds Catégorie: |

Equity |

| Région de placement: |

Worldwide |

| Branche: |

Sector Biotechnology |

| Benchmark: |

MSCI World Healthcare NR |

| Début de l'exercice: |

01/07 |

| Dernière distribution: |

- |

| Banque dépositaire: |

CACEIS Investor Services Bank |

| Domicile: |

Luxembourg |

| Permission de distribution: |

Austria, Germany, Switzerland, United Kingdom |

| Gestionnaire du fonds: |

Christian Lach, Lukas Leu, Oliver Kubli |

| Actif net: |

35.23 Mio.

USD

|

| Date de lancement: |

02/04/2009 |

| Focus de l'investissement: |

- |

Conditions

| Surtaxe d'émission: |

5.00% |

| Frais d'administration max.: |

1.60% |

| Investissement minimum: |

- EUR |

| Deposit fees: |

- |

| Frais de rachat: |

0.00% |

| Prospectus simplifié: |

Télécharger (Version imprimée) |

Société de fonds

| Société de fonds: |

Waystone M.Co.(Lux) |

| Adresse: |

19, rue de Bitbourg, 1273, Luxemburg |

| Pays: |

Luxembourg |

| Internet: |

www.waystone.com

|

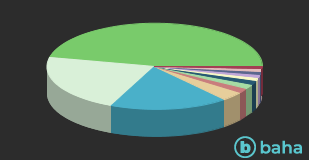

Pays

| United States of America |

|

67.53% |

| Denmark |

|

9.71% |

| Switzerland |

|

5.70% |

| United Kingdom |

|

4.22% |

| Ireland |

|

2.22% |

| Cash |

|

1.70% |

| Germany |

|

1.63% |

| Sweden |

|

1.56% |

| Spain |

|

1.12% |

| France |

|

0.94% |

| Japan |

|

0.92% |

| India |

|

0.90% |

| Brazil |

|

0.89% |

| China |

|

0.73% |

| Cayman Islands |

|

0.23% |

Branches

| Pharma/Biotechnology |

|

46.52% |

| Healthcare services |

|

21.90% |

| Healthcare appliances |

|

17.81% |

| Parma, wholesale |

|

3.50% |

| Cash |

|

1.70% |

| Grocery Producers |

|

1.69% |

| Leisure articles |

|

1.56% |

| consumer electronics |

|

1.17% |

| Clothing |

|

1.16% |

| Computer Hardware |

|

1.06% |

| Gesundheitswesen/ Informationstechnologie |

|

1.04% |

| amusement parks |

|

0.89% |