AXA WF Global Income Generation A Capitalisation EUR

LU0960400249

AXA WF Global Income Generation A Capitalisation EUR/ LU0960400249 /

| NAV06/05/2024 |

Diferencia+0.3400 |

Tipo de beneficio |

Enfoque de la inversión |

Sociedad de fondos |

| 114.9600EUR |

+0.30% |

reinvestment |

Mixed Fund

Worldwide

|

AXA Fds. Management ▶ |

Estrategia de inversión

The Sub-Fund is a multi asset class portfolio, seeking to provide regular income and to achieve medium term capital growth through dynamic and flexible allocation across a wide array of asset classes globally. The Sub-Fund is actively managed without reference to any benchmark. The Sub-Fund is actively and discretionarily managed in order to capture opportunities across a wide array of asset classes, with an investment strategy that uses: - strategic asset allocation (based on long term macroeconomic views) - tactical asset allocation (based on the identification of short term market opportunities) - extensive diversification, with no formal restriction on the proportion of assets that can be allocated to any one particular market. This diversification aims at exposing the Sub-Fund to a moderate level of volatility

The Sub-Fund is invested in a broad set of world market bonds (including highincome generating bonds, either unrated, rated below or above investment grade) and equities (including high dividend equities through fundamental approach and/or the use of a proprietary quantitative process). The Sub-Fund may also get exposure to other asset classes including without limitation real estate, volatility of equity markets, commodities (notably through commodity indices, exchange traded funds, equities). Over the long term a high proportion of the Sub-Fund's assets will be invested in fixed income and Money Market Instruments. The allocation between the various asset classes is decided in a flexible and discretionary manner. The proportion of the Sub-Fund's assets that can be invested in equities and/or in commodities is very flexible and may vary from 0% to 50%.

Objetivo de inversión

The Sub-Fund is a multi asset class portfolio, seeking to provide regular income and to achieve medium term capital growth through dynamic and flexible allocation across a wide array of asset classes globally. The Sub-Fund is actively managed without reference to any benchmark. The Sub-Fund is actively and discretionarily managed in order to capture opportunities across a wide array of asset classes, with an investment strategy that uses: - strategic asset allocation (based on long term macroeconomic views) - tactical asset allocation (based on the identification of short term market opportunities) - extensive diversification, with no formal restriction on the proportion of assets that can be allocated to any one particular market. This diversification aims at exposing the Sub-Fund to a moderate level of volatility

Datos maestros

| Tipo de beneficio: |

reinvestment |

| Categoría de fondos: |

Mixed Fund |

| Región: |

Worldwide |

| Sucursal: |

Multi-asset |

| Punto de referencia: |

20% BofA Merrill Lynch Global Large Cap Hedged EUR + 15% MSCI AC World Total Return Net + 15% EONIA Capitalized + 15% B |

| Inicio del año fiscal: |

01/01 |

| Última distribución: |

- |

| Banco depositario: |

State Street Bank International GmbH (Luxembourg Branch) |

| País de origen: |

Luxembourg |

| Permiso de distribución: |

Austria, Germany, Switzerland |

| Gestor de fondo: |

Andrew Etherington, Cesar Vanneaux |

| Volumen de fondo: |

405.12 millones

EUR

|

| Fecha de fundación: |

16/09/2015 |

| Enfoque de la inversión: |

- |

Condiciones

| Recargo de emisión: |

5.50% |

| Max. Comisión de administración: |

1.25% |

| Inversión mínima: |

0.00 EUR |

| Deposit fees: |

- |

| Cargo por amortización: |

0.00% |

| Prospecto simplificado: |

Descargar (Versión para imprimir) |

Sociedad de fondos

| Fondos de empresa: |

AXA Fds. Management |

| Dirección: |

49, Avenue J.F. Kennedy, 1855, Luxembourg |

| País: |

Luxembourg |

| Internet: |

www.axa-im.com

|

Activos

| Bonds |

|

62.51% |

| Stocks |

|

29.65% |

| Mutual Funds |

|

4.22% |

| Cash |

|

3.62% |

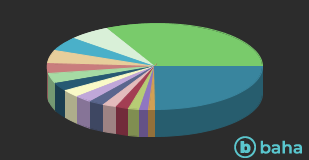

Países

| United States of America |

|

32.38% |

| France |

|

6.24% |

| United Kingdom |

|

5.32% |

| Netherlands |

|

5.07% |

| Germany |

|

3.69% |

| Cash |

|

3.62% |

| Italy |

|

3.13% |

| Japan |

|

2.79% |

| Spain |

|

2.69% |

| Luxembourg |

|

2.20% |

| Switzerland |

|

2.14% |

| Canada |

|

1.88% |

| Sweden |

|

1.64% |

| Ireland |

|

1.38% |

| Romania |

|

1.02% |

| Otros |

|

24.81% |

Divisas

| US Dollar |

|

58.20% |

| Euro |

|

23.60% |

| Japanese Yen |

|

2.79% |

| British Pound |

|

1.76% |

| Swiss Franc |

|

1.55% |

| Swedish Krona |

|

1.08% |

| Korean Won |

|

0.92% |

| Canadian Dollar |

|

0.72% |

| Taiwan Dollar |

|

0.39% |

| Chinese Yuan Renminbi |

|

0.31% |

| New Zealand Dollar |

|

0.27% |

| Malaysian Ringgit |

|

0.25% |

| Australian Dollar |

|

0.24% |

| Otros |

|

7.92% |