AXA WF Defensive Optimal Income F Capitalisation EUR

LU0094159554

AXA WF Defensive Optimal Income F Capitalisation EUR/ LU0094159554 /

| NAV15/05/2024 |

Chg.+0.5300 |

Type de rendement |

Focus sur l'investissement |

Société de fonds |

| 80.4300EUR |

+0.66% |

reinvestment |

Mixed Fund

Worldwide

|

AXA Fds. Management ▶ |

Stratégie d'investissement

The Sub-Fund seeks to achieve medium term capital growth by investing in a diversified portfolio of broad asset classes, through a defensive approach.

The Investment Manager will seek to achieve the objectives of the Sub-Fund by investing in/exposing the Sub-Fund to a set of equities (up to 35% of the net assets of the Sub-Fund) and/or investing in or being exposed up to 100% of its net assets in one or more of the following asset classes: transferable debt securities issued by any governments, investment grade corporate securities and/or money market instruments. The Investment manager may invest up to 40% of its assets in securities from emerging markets. Within the above 35% limit, the Sub-Fund may invest up to 20% of its assets in small capitalization companies. The Sub-Fund may also invest in or be exposed to callable bonds up to 50% of its net assets. The Sub-Fund invests/ is exposed to no more than 20% of its net assets in transferable debt securities rated sub investment grade and up to 15% in securities traded on the CIBM through Bond Connect. The Sub-Fund may, up to 10%, hold distressed and defaulted securities as a result of their rating downgrade, if they are considered to be consistent with the Sub-Fund's objective. These securities are expected to be sold within 6 months unless specific events prevent the Investment Manager from sourcing their liquidity.

Objectif d'investissement

The Sub-Fund seeks to achieve medium term capital growth by investing in a diversified portfolio of broad asset classes, through a defensive approach.

Opérations

| Type de rendement: |

reinvestment |

| Fonds Catégorie: |

Mixed Fund |

| Région de placement: |

Worldwide |

| Branche: |

Mixed Fund/Focus Bonds |

| Benchmark: |

- |

| Début de l'exercice: |

01/01 |

| Dernière distribution: |

- |

| Banque dépositaire: |

State Street Bank International GmbH |

| Domicile: |

Luxembourg |

| Permission de distribution: |

Austria, Germany, Switzerland |

| Gestionnaire du fonds: |

Qian Liu, Laurent Clavel |

| Actif net: |

196.88 Mio.

EUR

|

| Date de lancement: |

18/01/1999 |

| Focus de l'investissement: |

- |

Conditions

| Surtaxe d'émission: |

2.00% |

| Frais d'administration max.: |

0.50% |

| Investissement minimum: |

0.00 EUR |

| Deposit fees: |

- |

| Frais de rachat: |

0.00% |

| Prospectus simplifié: |

Télécharger (Version imprimée) |

Société de fonds

| Société de fonds: |

AXA Fds. Management |

| Adresse: |

49, Avenue J.F. Kennedy, 1855, Luxembourg |

| Pays: |

Luxembourg |

| Internet: |

www.axa-im.com

|

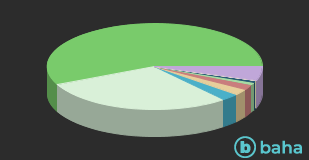

Actifs

| Bonds |

|

53.98% |

| Stocks |

|

39.27% |

| Cash |

|

2.86% |

| Mutual Funds |

|

2.30% |

| Certificates |

|

1.58% |

| Autres |

|

0.01% |

Pays

| United States of America |

|

21.76% |

| France |

|

14.07% |

| Italy |

|

9.03% |

| Netherlands |

|

7.64% |

| United Kingdom |

|

6.72% |

| Spain |

|

4.76% |

| Germany |

|

3.61% |

| Japan |

|

2.99% |

| Cash |

|

2.86% |

| Ireland |

|

2.66% |

| Sweden |

|

2.58% |

| Switzerland |

|

1.81% |

| Denmark |

|

1.29% |

| Belgium |

|

1.28% |

| Austria |

|

1.11% |

| Autres |

|

15.83% |

Monnaies

| Euro |

|

57.04% |

| US Dollar |

|

29.13% |

| Japanese Yen |

|

2.63% |

| British Pound |

|

2.26% |

| Swedish Krona |

|

1.88% |

| Swiss Franc |

|

1.00% |

| Israeli New Shekel |

|

0.59% |

| Danish Krone |

|

0.31% |

| Autres |

|

5.16% |