Amundi Fds.Real Assets Tar.Inc.A2

LU1883866011

Amundi Fds.Real Assets Tar.Inc.A2/ LU1883866011 /

| NAV23/05/2024 |

Var.-0.4200 |

Type of yield |

Focus sugli investimenti |

Società d'investimento |

| 61.2100EUR |

-0.68% |

reinvestment |

Mixed Fund

Worldwide

|

Amundi Luxembourg ▶ |

Investment strategy

Seeks to increase the value of your investment (mainly through income) over the recommended holding period, while achieving an ESG score greater than that of the benchmark.

The sub-fund is actively managed. It mainly invests in equities and corporate and government bonds anywhere in the world, including emerging markets. Bond investments may be below investment grade.The sub-fund may or may not hedge currency risk at the portfolio level at the discretion of the investment manager. The sub-fund uses derivatives to reduce various risks (hedging), manage the portfolio more efficiently, and gain exposure (long or short) to various assets, markets or other investment opportunities such as credit, interest rates and foreign exchange. Management process: In actively managing the sub-fund, the investment manager uses a combination of macroeconomic and market analysis to flexibly allocate investments across asset classes and identify opportunities that appear to offer above average income prospects (top-down approach). The investment manager is not constrained by the benchmark for the construction of the portfolio and makes its own investment decisions.

Investment goal

Seeks to increase the value of your investment (mainly through income) over the recommended holding period, while achieving an ESG score greater than that of the benchmark.

Dati master

| Type of yield: |

reinvestment |

| Fondi Categoria: |

Mixed Fund |

| Region: |

Worldwide |

| Settore: |

Multi-asset |

| Benchmark: |

15 % MSCI AC World REITS Index, 10 % MSCI World, Food Beverage and Tobacco Index, 10 % MSCI World Materials Index |

| Business year start: |

01/07 |

| Ultima distribuzione: |

- |

| Banca depositaria: |

CACEIS Bank, Niederlassung Luxemburg |

| Domicilio del fondo: |

Luxembourg |

| Permesso di distribuzione: |

Austria, Germany, Switzerland, Luxembourg |

| Gestore del fondo: |

- |

| Volume del fondo: |

207.92 mill.

USD

|

| Data di lancio: |

07/06/2019 |

| Investment focus: |

- |

Condizioni

| Sovrapprezzo emissione: |

4.50% |

| Tassa amministrativa massima: |

1.50% |

| Investimento minimo: |

0.00 EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Prospetto semplificato: |

Download (Print version) |

Società d'investimento

| Funds company: |

Amundi Luxembourg |

| Indirizzo: |

5 allée Scheffer, L-2520, Luxemburg |

| Paese: |

Luxembourg |

| Internet: |

www.amundi.lu

|

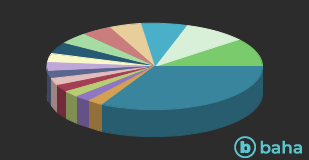

Paesi

| Turkey |

|

10.83% |

| Brazil |

|

9.37% |

| Colombia |

|

6.88% |

| Argentina |

|

4.80% |

| India |

|

4.55% |

| Mexico |

|

4.50% |

| Macao |

|

4.34% |

| Israel |

|

3.26% |

| Ukraine |

|

3.22% |

| United Kingdom |

|

2.82% |

| China |

|

2.69% |

| Hong Kong, SAR of China |

|

2.50% |

| Indonesia |

|

2.44% |

| United Arab Emirates |

|

2.43% |

| Nigeria |

|

2.41% |

| Altri |

|

32.96% |