Amundi Fd.Sol.ICAV Gl.Mul.As.Gr.A2 EUR

IE00BMF7FS22

Amundi Fd.Sol.ICAV Gl.Mul.As.Gr.A2 EUR/ IE00BMF7FS22 /

| Стоимость чистых активов13.05.2024 |

Изменение-0.1700 |

Тип доходности |

Инвестиционная направленность |

Инвестиционная компания |

| 55.0700EUR |

-0.31% |

paying dividend |

Mixed Fund

Worldwide

|

Amundi (IE) ▶ |

Инвестиционная стратегия

The Sub-Fund seeks to achieve its investment objective by investing mainly in a broad range of global equities, Equity Related Securities and government and corporate Investment Grade bonds (fixed or floating rate). The Sub-Fund may also invest up to 20% of its Net Asset Value in below Investment Grade government and corporate bonds fixed or floating rate) and up to 10% of its Net Asset Value in convertible bonds, which shall not embed derivatives and/or leverage (the Sub-Fund shall not however invest in contingent convertible securities).

Such securities are listed or traded on a Permitted Market and may be from anywhere in the world, including up to 50% of its Net Asset Value in Emerging Markets. The Sub-Fund will not invest more than 5% of its Net Asset Value in securities that are listed/traded on the Moscow exchange. The Sub-Fund may also have indirect exposure to commodities (up to 20% of its Net Asset Value) through investment in other collective investment schemes and Exchange Traded Commodities and real estate investment trusts (up to 10% of its Net Asset Value) through investment in such collective investment schemes.

Инвестиционная цель

The Sub-Fund seeks to achieve its investment objective by investing mainly in a broad range of global equities, Equity Related Securities and government and corporate Investment Grade bonds (fixed or floating rate). The Sub-Fund may also invest up to 20% of its Net Asset Value in below Investment Grade government and corporate bonds fixed or floating rate) and up to 10% of its Net Asset Value in convertible bonds, which shall not embed derivatives and/or leverage (the Sub-Fund shall not however invest in contingent convertible securities).

Основные данные

| Тип доходности: |

paying dividend |

| Категории фондов: |

Mixed Fund |

| Регион: |

Worldwide |

| Branch: |

Mixed fund/flexible |

| Бенчмарк: |

30% BLOOMBERG GLOBAL AGGREGATE, 70% MSCI ACWI |

| Начало рабочего (бизнес) года: |

01.01 |

| Last Distribution: |

- |

| Депозитарный банк: |

Société Générale S.A., Dublin Branch |

| Место жительства фонда: |

Ireland |

| Разрешение на распространение: |

Germany |

| Управляющий фондом: |

Francesco Sandrini, Enrico Bovalini, Marco Impagnatiello |

| Объем фонда: |

31.99 млн

USD

|

| Дата запуска: |

22.04.2021 |

| Инвестиционная направленность: |

- |

Условия

| Эмиссионная надбавка: |

5.00% |

| Max. Administration Fee: |

1.60% |

| Минимальное вложение: |

0.00 EUR |

| Deposit fees: |

- |

| Комиссионные, взимаемые фондами взаимных инвестиций при погашении акций: |

3.00% |

| Упрощенный проспект: |

- |

Инвестиционная компания

| Товарищества на вере: |

Amundi (IE) |

| Адрес: |

- |

| Страна: |

Ireland |

| Интернет: |

www.amundi.ie

|

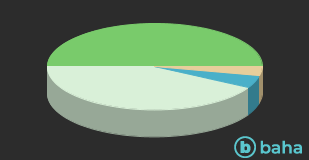

Активы

| Stocks |

|

49.83% |

| Bonds |

|

42.15% |

| Cash |

|

4.55% |

| Commodities |

|

3.47% |

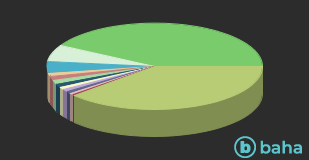

Страны

| United States of America |

|

41.96% |

| Luxembourg |

|

6.34% |

| Japan |

|

4.14% |

| United Kingdom |

|

1.47% |

| Canada |

|

1.44% |

| Ireland |

|

1.37% |

| Australia |

|

1.21% |

| Netherlands |

|

1.11% |

| France |

|

0.98% |

| Germany |

|

0.67% |

| Switzerland |

|

0.64% |

| Italy |

|

0.41% |

| Другие |

|

38.26% |

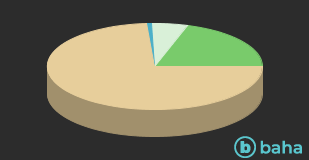

Валюта

| Euro |

|

20.11% |

| US Dollar |

|

5.35% |

| British Pound |

|

0.70% |

| Другие |

|

73.84% |