Amundi Fd.Sol.ICAV Gl.Mul.As.Gr.A2 EUR

IE00BMF7FS22

Amundi Fd.Sol.ICAV Gl.Mul.As.Gr.A2 EUR/ IE00BMF7FS22 /

| NAV10/05/2024 |

Diferencia+0.1100 |

Tipo de beneficio |

Enfoque de la inversión |

Sociedad de fondos |

| 55.2400EUR |

+0.20% |

paying dividend |

Mixed Fund

Worldwide

|

Amundi (IE) ▶ |

Estrategia de inversión

The Sub-Fund seeks to achieve its investment objective by investing mainly in a broad range of global equities, Equity Related Securities and government and corporate Investment Grade bonds (fixed or floating rate). The Sub-Fund may also invest up to 20% of its Net Asset Value in below Investment Grade government and corporate bonds fixed or floating rate) and up to 10% of its Net Asset Value in convertible bonds, which shall not embed derivatives and/or leverage (the Sub-Fund shall not however invest in contingent convertible securities).

Such securities are listed or traded on a Permitted Market and may be from anywhere in the world, including up to 50% of its Net Asset Value in Emerging Markets. The Sub-Fund will not invest more than 5% of its Net Asset Value in securities that are listed/traded on the Moscow exchange. The Sub-Fund may also have indirect exposure to commodities (up to 20% of its Net Asset Value) through investment in other collective investment schemes and Exchange Traded Commodities and real estate investment trusts (up to 10% of its Net Asset Value) through investment in such collective investment schemes.

Objetivo de inversión

The Sub-Fund seeks to achieve its investment objective by investing mainly in a broad range of global equities, Equity Related Securities and government and corporate Investment Grade bonds (fixed or floating rate). The Sub-Fund may also invest up to 20% of its Net Asset Value in below Investment Grade government and corporate bonds fixed or floating rate) and up to 10% of its Net Asset Value in convertible bonds, which shall not embed derivatives and/or leverage (the Sub-Fund shall not however invest in contingent convertible securities).

Datos maestros

| Tipo de beneficio: |

paying dividend |

| Categoría de fondos: |

Mixed Fund |

| Región: |

Worldwide |

| Sucursal: |

Mixed fund/flexible |

| Punto de referencia: |

30% BLOOMBERG GLOBAL AGGREGATE, 70% MSCI ACWI |

| Inicio del año fiscal: |

01/01 |

| Última distribución: |

- |

| Banco depositario: |

Société Générale S.A., Dublin Branch |

| País de origen: |

Ireland |

| Permiso de distribución: |

Germany |

| Gestor de fondo: |

Francesco Sandrini, Enrico Bovalini, Marco Impagnatiello |

| Volumen de fondo: |

32.09 millones

USD

|

| Fecha de fundación: |

22/04/2021 |

| Enfoque de la inversión: |

- |

Condiciones

| Recargo de emisión: |

5.00% |

| Max. Comisión de administración: |

1.60% |

| Inversión mínima: |

0.00 EUR |

| Deposit fees: |

- |

| Cargo por amortización: |

3.00% |

| Prospecto simplificado: |

- |

Sociedad de fondos

| Fondos de empresa: |

Amundi (IE) |

| Dirección: |

- |

| País: |

Ireland |

| Internet: |

www.amundi.ie

|

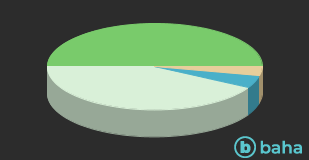

Activos

| Stocks |

|

49.83% |

| Bonds |

|

42.15% |

| Cash |

|

4.55% |

| Commodities |

|

3.47% |

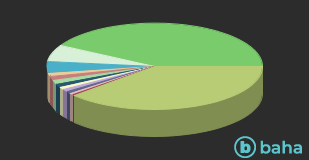

Países

| United States of America |

|

41.96% |

| Luxembourg |

|

6.34% |

| Japan |

|

4.14% |

| United Kingdom |

|

1.47% |

| Canada |

|

1.44% |

| Ireland |

|

1.37% |

| Australia |

|

1.21% |

| Netherlands |

|

1.11% |

| France |

|

0.98% |

| Germany |

|

0.67% |

| Switzerland |

|

0.64% |

| Italy |

|

0.41% |

| Otros |

|

38.26% |

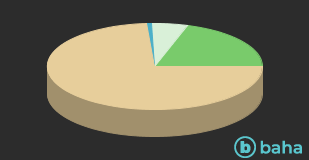

Divisas

| Euro |

|

20.11% |

| US Dollar |

|

5.35% |

| British Pound |

|

0.70% |

| Otros |

|

73.84% |