Allianz Europe Equity Growth Select - A - EUR

LU0908554255

Allianz Europe Equity Growth Select - A - EUR/ LU0908554255 /

| NAV10.05.2024 |

Zm.+1,8500 |

Typ dystrybucji dochodów |

Kategoria |

Firma inwestycyjna |

| 228,5100EUR |

+0,82% |

płacące dywidendę |

Akcje

Europa

|

Allianz Gl.Investors ▶ |

Strategia inwestycyjna

Long-term capital growth by investing in European Equity Markets with a focus on growth stocks of large market capitalization companies in accordance with the Sustainability Key Performance Indicator Strategy (Relative) ("KPI Strategy (Relative)"). In this context, the aim is to outperform the Sub- Fund"s Sustainability KPI compared to Sub-Fund"s Benchmark to achieve the investment objective. The Sub-Fund follows the KPI Strategy (Relative) and promotes responsible investments by applying a sustainability key performance indicator ("Sustainability KPI") to provide transparency on the measurable sustainability outcome pursued by the Sub-Fund"s Investment Manager for the shareholders. Minimum exclusion criteria for direct investments are applied.

Min. 70% of Sub-Fund assets are invested in Equities as described in the investment objective. Large market capitalization companies means companies whose market capitalization is at least EUR 5 billion as determined at the time of acquisition. Max. 30% of Sub-Fund assets may be invested in Equities other than described in the investment objective. Max. 20% of Sub-Fund assets may be invested in Emerging Markets. Max. 25% of Sub Fund assets may be held directly in time deposits and/or (up to 20% of Sub-Fund assets) in deposits at sight and/or invested in Money Market Instruments and/or (up to 10% of Sub-Fund assets) in money market funds for liquidity management. Max. 10% of Sub-Fund assets may be invested in UCITS/UCI. Sub-Fund classifies as "equity-fund" according to German Investment Tax Act (GITA). We manage this Sub-Fund in reference to a Benchmark which plays a role for the Sub-Fund"s performance objectives and measures. We follow an active management approach with the aim to outperform the Benchmark. Although our deviation from the investment universe, weightings and risk characteristics of the Benchmark is likely to be material in our own discretion, the majority of the Sub-Fund's investments (excluding derivatives) may consist of components of the Benchmark.

Cel inwestycyjny

Long-term capital growth by investing in European Equity Markets with a focus on growth stocks of large market capitalization companies in accordance with the Sustainability Key Performance Indicator Strategy (Relative) ("KPI Strategy (Relative)"). In this context, the aim is to outperform the Sub- Fund"s Sustainability KPI compared to Sub-Fund"s Benchmark to achieve the investment objective. The Sub-Fund follows the KPI Strategy (Relative) and promotes responsible investments by applying a sustainability key performance indicator ("Sustainability KPI") to provide transparency on the measurable sustainability outcome pursued by the Sub-Fund"s Investment Manager for the shareholders. Minimum exclusion criteria for direct investments are applied.

Dane podstawowe

| Typ dystrybucji dochodów: |

płacące dywidendę |

| Kategoria funduszy: |

Akcje |

| Region: |

Europa |

| Branża: |

Różne sektory |

| Benchmark: |

S&P EUROPE LARGECAP GROWTH (EURO CURRENCY) RETURN NET IN EUR |

| Początek roku obrachunkowego: |

01.10 |

| Last Distribution: |

15.12.2023 |

| Bank depozytariusz: |

State Street Bank International GmbH - Luxembourg Branch |

| Kraj pochodzenia funduszu: |

Luxemburg |

| Zezwolenie na dystrybucję: |

Austria, Niemcy, Szwajcaria, Luxemburg |

| Zarządzający funduszem: |

Giovanni Trombello, Andreas Hildebrand |

| Aktywa: |

1,01 mld

EUR

|

| Data startu: |

02.05.2013 |

| Koncentracja inwestycyjna: |

- |

Warunki

| Opłata za nabycie: |

5,00% |

| Max. Administration Fee: |

1,50% |

| Minimalna inwestycja: |

- EUR |

| Opłaty depozytowe: |

- |

| Opłata za odkupienie: |

0,00% |

| Uproszczony prospekt: |

Ściągnij (Wersja do wydruku) |

Firma inwestycyjna

| TFI: |

Allianz Gl.Investors |

| Adres: |

Bockenheimer Landstraße 42-44, 60323, Frankfurt am Main |

| Kraj: |

Niemcy |

| Internet: |

www.allianzgi.com

|

Aktywa

| Akcje |

|

99,23% |

| Gotówka |

|

0,77% |

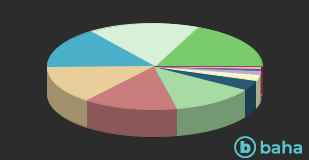

Kraje

| Dania |

|

18,49% |

| Szwecja |

|

16,67% |

| Francja |

|

15,06% |

| Szwajcaria |

|

14,11% |

| Niemcy |

|

14,08% |

| Holandia |

|

12,65% |

| Irlandia |

|

3,74% |

| Wielka Brytania |

|

2,27% |

| Luxemburg |

|

1,30% |

| Włochy |

|

0,83% |

| Gotówka |

|

0,77% |

| Inne |

|

0,03% |

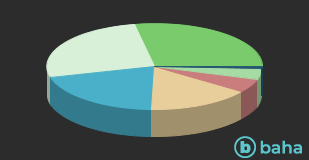

Branże

| IT/Telekomunikacja |

|

27,98% |

| Przemysł |

|

26,29% |

| Opieka zdrowotna |

|

20,29% |

| Dobra konsumpcyjne |

|

15,54% |

| Towary |

|

5,14% |

| Finanse |

|

3,99% |

| Pieniądze |

|

0,77% |