AGIF-Al.Eu.Small and Micro C.Eq.AT EUR

LU1941714476

AGIF-Al.Eu.Small and Micro C.Eq.AT EUR/ LU1941714476 /

| Стоимость чистых активов10.05.2024 |

Изменение+1.4600 |

Тип доходности |

Инвестиционная направленность |

Инвестиционная компания |

| 134.2500EUR |

+1.10% |

reinvestment |

Equity

Europe

|

Allianz Gl.Investors ▶ |

Инвестиционная стратегия

Long-term capital growth by investing in European Equity Markets with a focus on micro to small cap companies. The Sub-Fund is PEA-PME (Plan d"Epargne en Actions destiné au financement des PME et ETI) eligible in France. Min. 90% of Sub-Fund assets are permanently physically invested in Equities in accordance with the Investment Objective. Max. 10% of Sub-Fund assets may be invested us by in Equities other than described in the Investment Objective. Max. 30% of Sub-Fund asset may be invested in Emerging Markets. Max. 10% of Sub-Fund assets may be invested in convertible debt securities and/or in contingent convertible bonds . Max. 10% of Sub Fund assets may be held directly in Deposits and/or invested in Money Market Instruments and/or (up to 10% of Sub-Fund assets) in money market funds for liquidity management. Max. 10% of Sub-Fund assets may be invested in UCITS/UCI. Sub-Fund classifies as "equity-fund" according to German Investment Tax Act (GITA).

We manage this Sub-Fund in reference to a Benchmark which plays a role for the Sub-Fund"s performance objectives and measures. We follow an active management approach with the aim to outperform the Benchmark. Although our deviation from the investment universe, weightings and risk characteristics of the Benchmark is likely to be significant in our own discretion, the majority of the Sub-Fund's investments (excluding derivatives) may consist of components of the Benchmark.

Инвестиционная цель

Long-term capital growth by investing in European Equity Markets with a focus on micro to small cap companies. The Sub-Fund is PEA-PME (Plan d"Epargne en Actions destiné au financement des PME et ETI) eligible in France. Min. 90% of Sub-Fund assets are permanently physically invested in Equities in accordance with the Investment Objective. Max. 10% of Sub-Fund assets may be invested us by in Equities other than described in the Investment Objective. Max. 30% of Sub-Fund asset may be invested in Emerging Markets. Max. 10% of Sub-Fund assets may be invested in convertible debt securities and/or in contingent convertible bonds . Max. 10% of Sub Fund assets may be held directly in Deposits and/or invested in Money Market Instruments and/or (up to 10% of Sub-Fund assets) in money market funds for liquidity management. Max. 10% of Sub-Fund assets may be invested in UCITS/UCI. Sub-Fund classifies as "equity-fund" according to German Investment Tax Act (GITA).

Основные данные

| Тип доходности: |

reinvestment |

| Категории фондов: |

Equity |

| Регион: |

Europe |

| Branch: |

Mixed Sectors |

| Бенчмарк: |

70% MSCI EUROPE EX UK SMALL CAP NETR EUR TOTAL RETURN (NET), 30% MSCI EUROPE EX UK MICRO CAP NETR... |

| Начало рабочего (бизнес) года: |

01.10 |

| Last Distribution: |

- |

| Депозитарный банк: |

State Street Bank International GmbH Luxembourg Branch |

| Место жительства фонда: |

Luxembourg |

| Разрешение на распространение: |

Luxembourg |

| Управляющий фондом: |

Heinrich Ey |

| Объем фонда: |

124.15 млн

EUR

|

| Дата запуска: |

22.07.2019 |

| Инвестиционная направленность: |

Small Cap |

Условия

| Эмиссионная надбавка: |

5.00% |

| Max. Administration Fee: |

1.50% |

| Минимальное вложение: |

- EUR |

| Deposit fees: |

- |

| Комиссионные, взимаемые фондами взаимных инвестиций при погашении акций: |

0.00% |

| Упрощенный проспект: |

Скачать (Версия для печати) |

Инвестиционная компания

| Товарищества на вере: |

Allianz Gl.Investors |

| Адрес: |

Bockenheimer Landstraße 42-44, 60323, Frankfurt am Main |

| Страна: |

Germany |

| Интернет: |

www.allianzgi.com

|

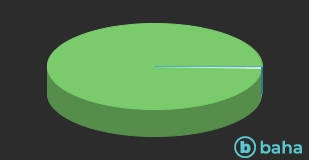

Активы

| Stocks |

|

99.43% |

| Cash |

|

0.46% |

| Другие |

|

0.11% |

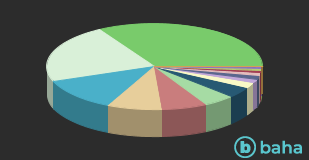

Страны

| Sweden |

|

33.53% |

| Germany |

|

22.23% |

| France |

|

12.19% |

| Netherlands |

|

8.18% |

| Finland |

|

6.84% |

| Italy |

|

4.83% |

| Ireland |

|

3.88% |

| Denmark |

|

2.13% |

| Austria |

|

1.43% |

| Norway |

|

1.41% |

| Faroe Islands |

|

1.00% |

| Spain |

|

0.94% |

| Switzerland |

|

0.84% |

| Cash |

|

0.46% |

| Другие |

|

0.11% |

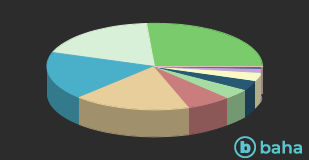

Отрасли

| IT/Telecommunication |

|

26.22% |

| Industry |

|

18.59% |

| Healthcare |

|

17.84% |

| Consumer goods |

|

17.60% |

| Finance |

|

6.69% |

| real estate |

|

3.99% |

| Commodities |

|

3.62% |

| Utilities |

|

3.28% |

| Energy |

|

1.59% |

| Cash |

|

0.46% |

| Другие |

|

0.12% |