AB FCP I Short Duration Bond Portfolio Class A

LU0069950391

AB FCP I Short Duration Bond Portfolio Class A/ LU0069950391 /

| NAV30/04/2024 |

Chg.-0.0100 |

Type de rendement |

Focus sur l'investissement |

Société de fonds |

| 7.1200USD |

-0.14% |

paying dividend |

Bonds

Worldwide

|

AllianceBernstein LU ▶ |

Stratégie d'investissement

Under normal circumstances, the Portfolio invests mainly in higher rated (Investment Grade) debt securities of governments, economic development organisations or companies anywhere in the world. It compares interest rate levels in different countries to determine where to invest, and also aims to identify securities that have the potential to increase in value. Under normal market conditions, at least 70% of the Portfolio's net assets will be denominated in or hedged to US Dollars (USD).

The Portfolio may utilise all bond markets where these debt securities are traded including Bond Connect. In addition, the Portfolio will, under normal market conditions, maintain an average duration of less than 5 years. The Portfolio may use derivatives (i) for efficient portfolio management and (ii) in seeking to reduce potential risks.

Objectif d'investissement

Under normal circumstances, the Portfolio invests mainly in higher rated (Investment Grade) debt securities of governments, economic development organisations or companies anywhere in the world. It compares interest rate levels in different countries to determine where to invest, and also aims to identify securities that have the potential to increase in value. Under normal market conditions, at least 70% of the Portfolio's net assets will be denominated in or hedged to US Dollars (USD).

Opérations

| Type de rendement: |

paying dividend |

| Fonds Catégorie: |

Bonds |

| Région de placement: |

Worldwide |

| Branche: |

Bonds: Mixed |

| Benchmark: |

Bloomberg Barclays Global 1-3 Year Treasury Index |

| Début de l'exercice: |

01/09 |

| Dernière distribution: |

28/03/2024 |

| Banque dépositaire: |

Brown Brothers Harriman (Luxembourg) S.C.A. |

| Domicile: |

Luxembourg |

| Permission de distribution: |

Austria, Germany, Switzerland, Luxembourg |

| Gestionnaire du fonds: |

Scott DiMaggio, Nicholas Sanders, John Taylor |

| Actif net: |

433.67 Mio.

USD

|

| Date de lancement: |

14/10/1996 |

| Focus de l'investissement: |

- |

Conditions

| Surtaxe d'émission: |

5.00% |

| Frais d'administration max.: |

0.85% |

| Investissement minimum: |

2,000.00 USD |

| Deposit fees: |

- |

| Frais de rachat: |

0.00% |

| Prospectus simplifié: |

Télécharger (Version imprimée) |

Société de fonds

| Société de fonds: |

AllianceBernstein LU |

| Adresse: |

2-4, rue Eugene Ruppert, 2453, Luxemburg |

| Pays: |

Luxembourg |

| Internet: |

www.alliancebernstein.com

|

Actifs

| Bonds |

|

89.68% |

| Cash |

|

1.62% |

| Autres |

|

8.70% |

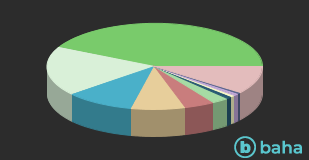

Pays

| United States of America |

|

43.74% |

| Japan |

|

9.67% |

| United Kingdom |

|

8.08% |

| Canada |

|

6.87% |

| France |

|

4.07% |

| Netherlands |

|

2.93% |

| Korea, Republic Of |

|

1.93% |

| Germany |

|

1.79% |

| Australia |

|

1.77% |

| Cash |

|

1.62% |

| Sweden |

|

1.25% |

| Finland |

|

0.93% |

| Ireland |

|

0.81% |

| Luxembourg |

|

0.80% |

| Colombia |

|

0.79% |

| Autres |

|

12.95% |

Monnaies

| US Dollar |

|

42.53% |

| Euro |

|

18.61% |

| British Pound |

|

10.37% |

| Japanese Yen |

|

8.19% |

| Australian Dollar |

|

4.56% |

| Canadian Dollar |

|

2.59% |

| Swedish Krona |

|

0.80% |

| Colombian Peso |

|

0.79% |

| Mexican Peso |

|

0.73% |

| Indian Rupee |

|

0.50% |

| Autres |

|

10.33% |